By Rick Sohn,

Umpqua Coquille LLC

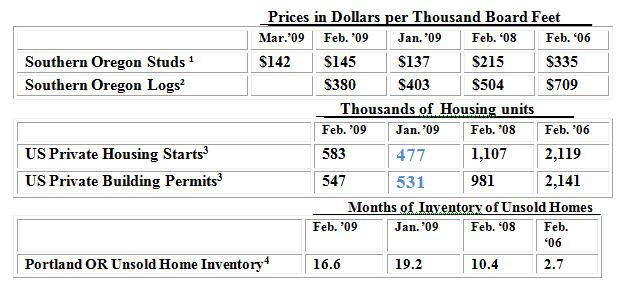

Shown below are the most recent prices for stud lumber and logs, housing starts and permits, and unsold home inventories. Past prices are provided for comparison.

What the numbers mean.

The prices mills will pay for logs, continues a serious slide that started at $500 per Thousand Board Feet (MBF) in October of 2008, reaching $380/MBF this month. Lumber, prices have been bouncing around a bottom, at or below $145 since December, 2008. Lumber prices have to improve before log prices will respond.

Housing starts and building permits have both shown one month of improvement, which will be a good sign if the trend continues for a few months. One factor that may be contributing is the mortgage interest rate, commonly reported to be about 4.75%. The slight decline in unsold inventories is also good news if the trend continues. Real Estate agents I have spoken to in Portland and Roseburg indicate that activity is up — more people are looking at homes, many for deals. According to the Portland Metro RMLS report for the February reporting period, the number of closed sales in the Portland area has also increased from 732 in January to 857 in February.

What others are saying.

In the last couple of weeks, I have talked to several timber industry executives, and asked them the question, “When will the market begin to turn around – not recover, just begin to turn?” There were no short answers, only elaborate ones. Here are the salient points.

• Timber Industry expectation about the time of the turnaround has changed radically in the last 1-4 months. Only half-joking, more than one said that answers to this question are better early in the week, or early each day, before that day’s bad news hits. The short answer is that no one expects the wood products industry to turn the corner until spring 2010 at the earliest.

• While some think we could be at the beginning of a prolonged bottom for lumber prices (not log prices) others think there is another leg down in this market, sometime 3-6 months out. How long that bottom lasts, no one is certain, but answers on the turnaround varied from spring 2010, which would be a little more than a year away, to 18 months – mid to late 2010, and one thinks it could easily take until spring of 2011 to turn around.

• Many industrial tree growers are just letting their inventory grow, with harvest levels as low as 25-50% of normal. Private woodland owners are simply not harvesting timber or selling logs.

• When recovery starts, not only manufacturing but also logging companies and support businesses will have to gear up again. It may be necessary for the core manufacturers and other industrial timberland owners to provide financing directly to hasten the startup of logging operations. In the past, many of these operations were in-house, but now as independent contractors, these businesses will not have the capital muscle to build their businesses quickly with banks alone.

• Inventories at suppliers such as Home Depot, Lowes, and wholesalers are low, so any bump in demand will cause a bump in prices. If prices bump up slightly, mills will open more shifts, and this in turn will add lumber supply, put downward pressure on lumber prices, and lead to a slow industry recovery. Supply and demand will have to find a new balance.

• The number of investment homes, including second homes will be unlikely to return to recent high levels, and this could create a “new normal” for construction in the 1.2-1.4 Million starts, as opposed to the “old normal” of 1.8 million or more. It is anticipated that home size will adjust from 3500-4500 square feet size, down to 2500 square feet, as was more common 30 years ago. Home buying and upkeep need to be more affordable.

• Timberlands may not be worth what people thought just a few years ago, and there may be some major shifts ahead in land ownership.

Where are we headed?

With housing starts and mortgages at such low rates, it is possible that new housing starts will trend upward before inventories of unsold homes reach previously normal levels. Contractors are also hungry for work at reduced prices. There seems to be a price bifurcation in the homes “for sale” market. One group of sellers has not accepted today’s lower home prices. Total market time for sales is 152 days in Portland, while the inventory is about 498 days (RMLS Portland Metro data). Homes that sell are those more recently listed at lower prices.

And, when the market does recover, what will be the new normal? If it were 1.8 million starts or more, as was common a few years ago, it would take nearly 7 years to get there from where we are today, at a 20% increase per year. To reach the “new normal” of 1.3 million level that some people cited above, will take over 4 years.

Again stay tuned, and lets see if some of the recent trends hold for a couple more months.

Data reports used with permission of:

1) Random Lengths. 2”x4”x8’ precision end treated hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week. One “board foot” measures 12 inches by 12 inches by one inch of product.

2) RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet are reported by standard log measurements using the “Scribner log table.”

3) Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, annually adjusted. Current report is for the prior month. Recent reports are often revised in bold from the prior month.

4) Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Broker. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

© Copyright Rick Sohn, #2-3 Umpqua Coquille LLC.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.