New technologies, supporting infrastructures, and greater demand will be needed to meet the country’s ambitious mandate to increase biofuel use.

By Amber Waves, USDA

– Constraints to future growth of the ethanol industry will present challenges to meeting the ambitious mandates for expanded biofuel use set forth in the Energy Independence and Security Act of 2007.

– New production technologies and supporting infrastructures will be needed to reach cellulosic biofuel mandates.

– Most U.S. motor vehicles are restricted by manufacturers’ warranties to use gasoline containing no more than 10 percent ethanol, which will limit growth in biofuel demand.

The Energy Independence and Security Act of 2007 specified an ambitious agenda to significantly expand biofuel use in the United States. Even so, the years of full-throttle expansion in the U.S. ethanol industry since 2000 may soon be behind us. The large gains in the scale of the industry over the past decade were achieved by “picking the low-hanging fruit” on both the supply and demand sides of the market. The technology for producing corn-based ethanol was already available, for example, and existing agricultural policy did not hinder the shift to increased corn acreage to support greater ethanol output.

Achieving further large-scale gains will depend on whether the industry can overcome challenges in producing ethanol through cellulosic technologies and on expanding use of ethanol in automobiles.

Expanded Use of Ethanol Was Within

Easy Reach

The role of ethanol in the U.S. gasoline supply has grown from just over 1 percent in 2000 to 7 percent in 2008. The increased use of ethanol was fueled by a combination of market conditions and policy factors, including rising oil prices, Federal tax credits, the first Renewable Fuel Standard established under the Energy Policy Act of 2005, and the elimination of methyl tertiary butyl ether (MTBE) as an oxygenating gasoline additive.

Almost all ethanol produced in the U.S. uses corn as the feedstock. The portion of U.S. corn utilization used to produce ethanol rose from 6 percent in 1999/2000 to 24 percent in 2007/08 and is projected to range from 30 to 35 percent over the next decade. And while ethanol’s expansion has contributed to higher farm commodity prices, supply and demand adjustments in the agricultural sector have helped mitigate overall impacts (see “U.S. Ethanol Expansion Driving Changes Throughout the Agricultural Sector,” in the September 2007 issue of Amber Waves).

The existing fleet of motor vehicles in the U.S. also permitted increased use of ethanol in the fuel supply. Moreover, the multistep distribution system linking ethanol production plants to retail gasoline stations was able to accommodate the growth of the industry with minimal adjustments.

New Renewable Fuel Standard Calls for Sharp Expansion in Biofuels

After several years of rapid expansion, the biofuels industry is now working on how to meet the new mandates in the Energy Independence and Security Act of 2007. The law, enacted in December 2007, calls for total renewable fuel “sold or introduced into commerce in the United States” to reach 36 billion gallons by 2022—nearly 5 times the 7.5-billion-gallon renewable fuel mandate for 2012 established in the Energy Policy Act of 2005.

Within the overall 36-billion-gallon mandate, the new Renewable Fuel Standard (RFS-2) sets specific amounts for different categories of biofuels—“cellulosic biofuel,” “biomass-based diesel,” and “advanced biofuel.” The RFS-2 also establishes eligibility criteria based on lifecycle greenhouse gas emissions for determining which biofuels qualify as “renewable fuel” and for the different categories (see box, “Renewable Fuel Standard Under the Energy Independence and Security Act of 2007”).

Meeting the mandates for biofuels laid out in the RFS-2 would require significant expansion of biofuel production and use from current U.S. levels. However, major challenges in both supply and demand may limit future growth in the industry.

Cellulosic Production Is a Challenge to Large Ethanol Expansion . . .

On the supply side, ethanol production from so-called “second generation” cellulosic feedstocks—such as corn stover, switchgrass, fast-growth trees, and forest residue—will require development of new technologies to be economically viable on a commercial scale. Even with progress on new cellulosic production technologies, the need to develop supporting infrastructures at every step along the way from the field to the pump will

further hinder rapid large-scale growth.

Production of dedicated energy crops, such as switchgrass, on the scale needed for commercially viable ethanol plants would be new for the agricultural sector. In some regions of the U.S., these new crops will need to generate sufficient profit for farmers to switch acreage from traditional crops. To do that, farmers will require a combination of yields, prices, and production costs to generate favorable net returns. To the extent that some dedicated energy crops take years to become fully productive, long-term contractual arrangements between farmers and ethanol producers likely will be needed to assure market demand and encourage the initial investment.

Crop residues, such as corn stover, provide another source of cellulosic matter for second-generation ethanol production. Prices for these residues will have to be sufficient to compensate farmers for the additional costs of collection and handling. Furthermore, farmers will need to take into account the environmental consequences of removing such residues and the potential impacts on returns for production of the primary crop in subsequent years if soil erosion or changes in production practices alter the productivity of the land.

A further consideration for second-generation ethanol production is that cellulosic feedstocks tend to be bulky. Transportation systems and storage facilities will need to be developed to manage the movement of cellulosic material and assure steady supplies of feedstocks at ethanol plants to maintain year-round operation. The need for such infrastructure developments was less of an issue for the expansion of corn-based ethanol, since the existing grain marketing system already included facilities for storing, handling, and transporting corn.

. . .and There Are Ethanol Demand Challenges, Too

Future growth in U.S. ethanol demand will be constrained by policies regarding allowable ethanol blends as well as characteristics of current gasoline motor vehicles, factors that are highly related.

Under current U.S. policy, ethanol is permitted to be blended with gasoline in mixtures up to 10 percent ethanol (E10), by volume, or 85 percent ethanol (E85). Midlevel blends with ethanol content above 10 percent but less than 85 percent are generally not permitted, except for use in flexible fuel vehicles.

Warranties permit most automobiles and other gasoline vehicles in the United States to use blends that include up to 10 percent ethanol. Automobile manufacturer warranties for these vehicles do not cover use of higher ethanol blends, due in part to potential effects on engines and engine performance that may result from higher corrosiveness and water affinity properties of ethanol.

Flexible-fuel vehicles can use blends up to 85 percent ethanol. The U.S. Department of Energy estimates that there were more than 6 million flexible-fuel vehicles in the United States as of 2008. While increasing in number, these flexible fuel vehicles account for less than 3 percent of the more than 135 million cars and 100 million vans, pickup trucks, and sport utility vehicles in the United States.

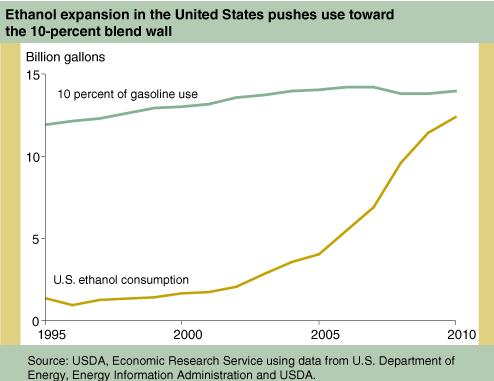

Ethanol Demand for E10 Will Hit the “Blend Wall” Soon

Ethanol use of E10 is expected to be near its maximum levels within a few years, hitting the so-called blend wall, as E10 reaches its saturation point in the gasoline market. Annual gasoline use (including ethanol blends) in the United States peaked at about 142 billion gallons in 2007 before falling to just under 138 billion gallons in 2008 due to record-high gasoline prices and the economic slowdown. Future growth in gasoline consumption will be affected by the size of any post-recession rebound in gasoline use, longer term gains in gasoline demand, and improvements in fuel efficiency.

As part of the Energy Independence and Security Act of 2007, the “Ten-in-Ten Fuel Economy Act” mandates increases in fuel economy standards. Included in this mandate, the fuel economy average for model year 2020 is set to reach at least 35 miles per gallon for the total fleet of passenger and non-passenger automobiles manufactured for sale in the U.S. for that model year, up from the current standard for passenger automobiles of 27.5 miles per gallon. Further, on May 19, 2009, President Barack Obama announced a plan for accelerated implementation of somewhat stronger fuel economy standards (as well as reductions in greenhouse gas emissions). This proposed rule will go through normal regulatory rulemaking and public comment procedures before becoming finalized.

Ironically, gains in fuel efficiency increase the challenge of meeting the RFS-2. The RFS-2 sets specific volumes for renewable fuel use, rather than stipulating larger shares for biofuels in the overall fuel market. Improved fuel efficiency will mean that the volumes of biofuels set forth in the RFS-2 will account for even greater shares of fuel use, necessitating a larger market penetration by biofuels.

Depending on the assumptions regarding growth in fuel demand and efficiency, gasoline use could range as high as 150 to 160 billion gallons in 2022. This suggests the E10 market will soon hit a maximum, with growth in subsequent years only reflecting increases in total gasoline use. Even if total gasoline use in 2022 reaches the high-end projection of 160 billion gallons, the maximum amount of ethanol that could be used in E10 would be 16 billion gallons–well short of the legislated RFS-2 of 36 billion gallons.

E85 Demand Has a Long Way To Go

With 10-percent ethanol blends expected to be nearing their saturation point, increased use of biofuels will depend on expanding the E85 market. Although E85 is used in corn- and ethanol-producing States such as Iowa, Missouri, and Minnesota, it is not widely available in most of the U.S. In particular, E85 is sold at only a few stations in most major population centers, where gasoline consumption is greatest. Currently, E85 accounts for less than 1 percent of the Nation’s total gasoline use.

Growth in the E85 market would require a larger number of flexible fuel motor vehicles, as well as an expanded distribution infrastructure to make E85 more widely available. Greater volumes of ethanol would need to be transported from ethanol plants to population centers, putting more demand on the rail and trucking infrastructure.

Perhaps most important, retail gasoline stations would need storage facilities and pumps that can accommodate E85, requiring significant investment. Many urban stations may lack the space needed to add E85 pumps.

Additionally, Underwriters Laboratories (UL), which conducts scientific tests of products to help ensure they meet national safety standards, would need to evaluate and provide safety certification of E85 dispensers and essential subassemblies. However, as of May 2009, UL had not received submissions from any manufacturers of an external fuel delivery hose, one of the essential subassembly parts needed for the safety certification. UL testing of other components of E85 dispensers has been completed.

Additional possible deterrents to investments in the E85 infrastructure include the uncertainties regarding future biofuel policies and developments of alternative energy technologies for motor vehicles, and their potential effects on the overall size of the E85 market.

Potential Role for Higher Midlevel Blends

If the Environmental Protection Agency (EPA) were to approve higher midlevel ethanol blends than E10, such as E15, it would expand ethanol demand but not entirely eliminate pressure to expand the E85 market. Again, assuming that gasoline use in 2022 totals as much as 150 to 160 billion gallons, a 15-percent ethanol blend would generate demand for 22.5 to 24 billion gallons of ethanol, still short of the overall RFS-2 mandate of 36 billion gallons.

One potential constraint in the delivery infrastructure system for higher midlevel blends was recently relaxed. In February 2009, United Laboratories announced support for permitting the use of existing UL-approved gasoline dispensing systems (intended for use with ethanol blends up to E10) for automobile fuel containing up to 15 percent ethanol. UL indicated that, compared with E10, fuels with a maximum of 15 percent ethanol present “no significant incremental risk of damage” to fuel dispensing systems.

Nonetheless, midlevel blends higher than E10 face other major challenges, including consumer acceptance. Current manufacturer warranties on nonflexible fuel automobiles cover use of ethanol blends up to 10 percent. To modify these warranties for higher ethanol blends, some agreement with the automobile industry would be needed. Such an agreement may be hard to achieve, particularly since the domestic automobile manufacturers are currently encountering their own economic problems. Studies are underway to evaluate the potential long-term effects of higher midlevel blends on automobile engines, with results important for forthcoming EPA decisions.

A further concern regarding higher midlevel blends is the potential effects on small-motor, off-road gasoline engines, such as those used in lawnmowers and power boats.

Public Policy Encourages Scientific Research

The many challenges facing future large-scale expansion of U.S. renewable fuels raise issues about the feasibility of meeting the new RFS-2. Public policy can help address these challenges by supporting scientific research to improve the economic viability of new technologies or by providing subsidies to ease a transition to alternative motor vehicle fuels. A number of programs aimed at encouraging expansion of biofuels are currently in effect:

*

The U.S. Department of Energy (DOE) has awarded a number of grants for cellulosic research, including work on advanced enzymes for converting cellulose into sugars. Other DOE grants have been awarded to support development of cellulosic ethanol plants.

*

USDA’s Agricultural Research Service has a program on Bioenergy and Energy Alternatives. Ongoing research priorities include the development of new bioenergy feedstocks, improvement of feedstock yields and production, and work on biorefining technologies.

*

Title IX (a specific energy title) of the Food, Conservation, and Energy Act of 2008 (the 2008 Farm Act) provides for support to farmers to establish and produce biomass crops, payments to farmers for the delivery of renewable biomass to a biomass conversion facility (thus assisting with the costs of biomass collection, harvest, storage, and transportation), and assistance for expanding production of advanced biofuels.

*

Title VII of the 2008 Farm Act includes authorization for funding for bioenergy research programs and establishes an agricultural bioenergy feedstock and energy efficiency research and extension initiative within USDA.

*

Federal tax credits for ethanol blending provide economic incentives to the industry. Current law provides for a $0.45-per-gallon tax credit for ethanol blending, with an additional $0.10 credit for small (60 million gallons capacity or less) ethanol producers for production up to 15 million gallons per year. Additional provisions provide for a total tax credit of as much as $1.01 per gallon for cellulosic-based ethanol.

Balancing Mandates, Environmental Concerns, and Market Constraints

The Energy Independence and Security Act of 2007 allows for waivers and modifications to the RFS-2 if EPA determines there is an inadequate domestic supply to meet the mandate or if the standard would severely harm the economy or environment of a State, a region, or the Nation. Further, the life-cycle greenhouse gas emissions criteria for the different portions of the RFS-2 may each be reduced by as much as 10 percentage points if EPA determines that the initially established criteria are not commercially feasible.

Additional environmental factors may also have a bearing on overall use of different biofuels and the potential for achieving the RFS-2. For example, California’s adoption of a low carbon fuel standard in April 2009 puts more stringent environmental criteria on fuel used in that State. The new standard is designed to reduce the carbon intensity of transportation fuels in California by 10 percent in 2020. The phased-in compliance schedule for the standard reduces the feasibility over time of using ethanol from some production pathways, depending on the feedstock, production location, and production process.

The biofuel market, scientific evidence regarding environmental impacts, and policy developments will need to be closely monitored to see how the situation evolves over the next decade and beyond. Overall implications for the agricultural sector suggest a continuing demand for feedstocks to produce ethanol. At a minimum, this demand will increase moderately in accordance with anticipated growth of gasoline usage in the country. Stronger growth will depend on whether the industry can overcome existing challenges to further expansion in ethanol production and use.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.