By Rick Sohn,

By Rick Sohn,

Umpqua Coquille LLC

August 24, 2009

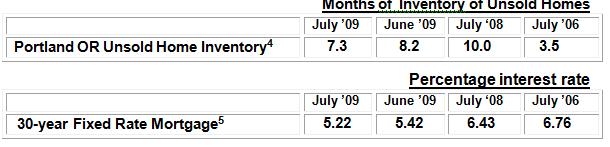

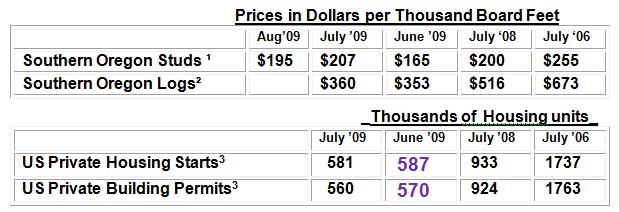

Lumber prices, housing starts and building permits fell slightly this month, signaling the reality of a longer, slower recovery in the wood products sector. One bright spot is the continued decline of the unsold home inventory. The 30-year fixed rate mortgage statistic, as compiled by Freddie Mac, is added to the Timber Industry Report this month. The mortgage interest rate is lower in July than June.

What the numbers mean.

It is encouraging that the unsold home inventory in Portland fell again, by 0.9% from July to June, although it fell 2% from June to May. However, there were no big headlines in the papers this month about housing starts, because signs of stagnation crept in, with the fall in both housing starts and building permits, and a slight fall in lumber prices. To drive the dismal housing starts and permits numbers up, unsold home inventory simply has to be flushed out of the pipeline. This is happening, steadily, as the number of closed sales in Portland has risen each month since January, according to RMLS. RMLS also reported for Portland that the number of closed sales for July 2009 actually surpassed July, 2008, coming in at 1,988.

In addition, log prices made a steady, although small move up for the third straight month, from a low of $346 reported for April, to $360 in July. And the interest rate for 30-year fixed rate mortgages has actually fallen slightly to 5.22, a very, very low rate by historic standards.

Yet, continued foreclosures, delistings of homes for sale from earlier this year, and other pent up demand to sell homes, will likely keep the unsold inventory above desirable levels for some time, as average prices continue to fall slightly.

The Freddie Mac national average 30-year fixed mortgage rate statistic has been added this month to the Timber Industry Report. Since last month, this mortgage interest rate statistic fell slightly. The 2009 mortgage interest rates are at the most attractive levels since 1971, and no doubt this helps keep some buyers in the market by making housing so affordable. A more detailed analysis of the mortgage interest rate is reported in the second half of this month’s report.

Data reports used with permission of:

1) Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2) RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3) Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, annually adjusted. Current report is for the prior month. Recent reports are often revised in bold from the prior month.

4) Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5) Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

© Copyright Rick Sohn, #2-8 Umpqua Coquille LLC. Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.