Timber Industry Report

By Rick Sohn,

Umpqua Coquille LLC

What goes up, comes down, much to everyone’s disappointment, but to no one’s surprise. Our lumber price is in a free fall, and mills have cut back temporarily shut down. See five-year-span price analysis of lumber, logs, housing starts, permits, unsold home inventory, and mortgage rates below.

Interpreting the trends.

Like a rocket launch, our lumber product indicator went up quickly and down even more quickly, without any orbit at higher levels. This dramatic fall in lumber and other wood product prices was widely predicted, but very disappointing. Unfortunately inventories are now full, and housing starts, which are a driving statistic of demand, are weakening. For the last 5 weeks, according to Random Lengths, lumber inventory buildup has exceeded orders.

From February to April, lumber went up from 275 to 333, but by June, it is back down to $235, a drop of $100 or 33% in just 2 months!!! With this freefall of prices, it should come as no surprise that many mills are cutting down the supply by either shutting down sawmill capacity temporarily or cutting back hours significantly.

It is not helping that housing starts are down about 10% while building permists are at an even lower level than starts. This is not a good trend.

At a Farm Credit Services Forest Products Customer Symposium on June 10, Lynn Michaelis, a Senior RISI Associate, projected that the long term demand for shelter is 1.7 million units per year for period 2010-2020. Housing starts are projected to improve to 1 million for 2011 – typically a bad-recession level, 1.5 million by 2012, and 1.8 million by 2014. Combined with other factors, a slow recovery is projected in 2010-2011, with momentum building in 2012-2014. While foreclosures may be peaking, they are a drag. Chile has now repaired all of its infrastructure from the earthquakes, and is producing again. Multi-family housing starts, a 20-30% component of our housing starts number, are very weak, tied into commercial real estate, and their recovery is “going nowhere,” says Michaelis.

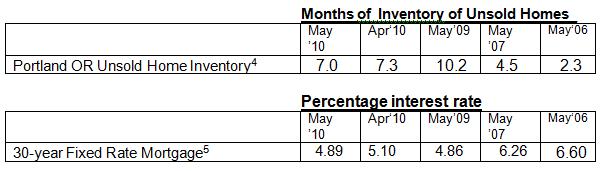

It is encouraging that we have bounced off the bottom of this great recession. The lumber price levels are still well above the $137-$142 level from December 2008 to March of 2009. Unsold inventory in Portland continues to go down, albeit slightly. Finally, in response to the uncertainty in the stock market, mortgage rates are near historic lows, continuing to make this an excellent time to tie up a 30-year mortgage.

Data reports used with permission of:

1) Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2) RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3) Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, annually adjusted. Current report is for the prior month. Recent reports are often revised in bold from the prior month. All of ’08 and ’09 were again revised in May 2010.

4) Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5) Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

© Copyright Rick Sohn, #3-6 Umpqua Coquille LLC. Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.