By Rick Sohn

Umpqua Coquille LLC

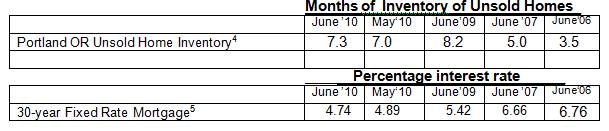

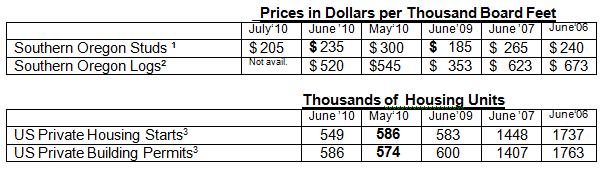

The bubble is still deflating, with falls, yet again in studs, logs, housing starts, and an increase in unsold inventory. Interest rates are eye-popping, the lowest on record, yet buyers are slow to commit. See below for five-year-span price analysis of lumber, logs, housing starts, permits, unsold home inventory, and mortgage rates.

On the positive side, it has been reported that new home sales are up 24% from a month earlier, to an annual rate of 330,000 although it is still the second worst month recorded. In Roseburg, Janet Johnston, with Prudential Real Estate, says that market activity has increased, but so has the time to close a sale, going from 30 to about 45 days, so positive statistics lag somewhat further behind. Also, interest rates are reported at 4.74%, the lowest on record. According to Janet, some brokers are providing financing at 4.62, or even as low as 4.25 percent. In over 40 years, there have never been more favorable interest rates. Porland real estate brokers have also told me that activity has picked up.

But the preponderance of news short term is not good. When asked, executives are finally saying they do not know when the recovery will come. Studs, logs, and housing starts have all fallen, and the inventory of unsold homes has bounced up slightly. Building permits are only up slightly. Mills are holding onto as many people as possible with minimal production schedules, again. And foreclosures have not abated. This is a vicious circle where people losing jobs due to the economy are now losing their houses. Recent articles, such as in Random Lengths and the Wall Street Journal, remain quite pessimistic.

Data reports used with permission of:

1) Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2) RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3) Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, annually adjusted. Current report is for the prior month. Recent reports are often revised in bold from the prior month. All of ’08 and ’09 were again revised in May 2010.

4Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5) Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

© Copyright Rick Sohn, #3-7 Umpqua Coquille LLC. Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.