By Rick Sohn

Umpqua Coquille,

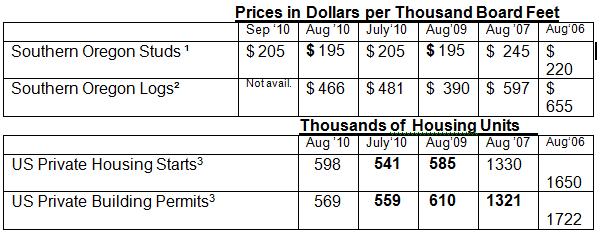

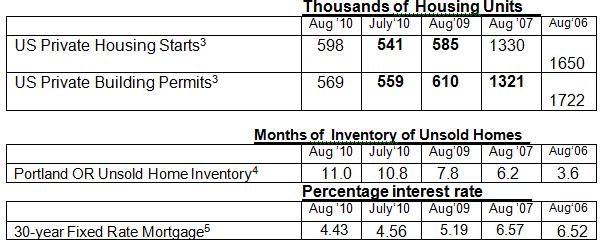

There are incremental improvements in the stud prices and housing starts, but high log prices are squeezing mills. Banks are a continuing roadblock with loan requirements and also appraisal valuations. See below for details and a five-year-span prices and analysis of lumber, logs, housing, and mortgage stats.

Interpreting the trends.

There is some good news this month that may produce another incremental uptick in the demand for wood products. Housing starts are up 10%. Studs are up $10. And mill inventories are adjusting to the volume of orders at the mills, according to tracking by Random Lengths, after about 4 months of too much inventory.

Mortgage Interest rates are at UNPRECEDENTED LEVELS, down to 4.43% for a 30-year fixed rate mortgage. This is getting attention. According to Janet Johnston in Roseburg, we are starting to see not only improved activity in the real estate market, but investors are starting to “nose around”. Despite the continued foreclosures and high unemployment, the overall economy is slowly creeping upwards due to strength in some sectors, and at these mortgage interest rates, people should be motivated.

Although August’s log price is trending down, it is still quite a bit higher than a year ago. This means that mills are actually more squeezed now than they were a year ago on pricing of logs versus lumber. Downward pressure on log prices will likely continue. Last month, Swanson’s mill in Glendale went down and Swanson reduced operating time in Roseburg. This month, Roseburg laid off a shift at the Dillard sawmill. These changes increase log supply relative to demand, and put downward pressure on log prices locally.

Banks are not promoting a housing recovery. According to one agent I spoke to in Portland, not only are they continuing to keep buyer qualifications very stringent, but they are also modifying the appraisal process. By using more online and out-of-area appraisers, specific value-added features of individual properties are missed. This produces artificially low “third party” appraisals, causing some deals to fall apart.

Loosening up by the banks will promote sales and lower the unsold home inventory. A decreased unsold inventory is a prerequisite to any sustained recovery. There is reason for cautious optimism, but the recovery will be very gradual, and most visible in the rearview mirror.

Data reports used with permission of:

1- Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2- RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3 – Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, annually adjusted. Current report is for the prior month. Recent reports are often revised in bold from the prior month. All of ’08 and ’09 were again revised in May 2010.

4- Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

Issue #3-9. © Copyright Rick Sohn, Umpqua Coquille LLC. For permission to reprint for nominal fee, Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.