Timber Industry Report

By Rick Sohn

Umqua Coquile LLC

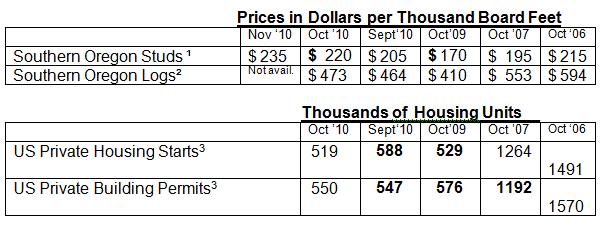

Lumber moves up yet another notch, unseasonally, along with logs, driven by exports. The domestic market continues to languish. Housing starts declined and unsold inventory rose slightly. See below for details and a five-year-span of prices and analysis of lumber, logs, housing, and mortgage stats.

Interpreting the trends.

China’s increased lumber purchases are good news for Douglas County mills and have pushed lumber prices to a healthy level. Swanson Group has re-opened its Glendale sawmill part-time to supply a 20-million board foot order to China, cut in metric sizes, as reported in the News Review. Also reported, Canada expects to supply 2.5 billion board feet of lumber in 2010, so Oregon and Washington are late to the game. Nordic Veneer is also making investments and improvements in its plant in Roseburg.

Log prices are also up, at a time of the year when log prices are traditionally dropping. One contributing factor is the demand for US logs. The US has already supplied nearly a half billion board feet of softwood logs to China, as reported by Random Lengths.

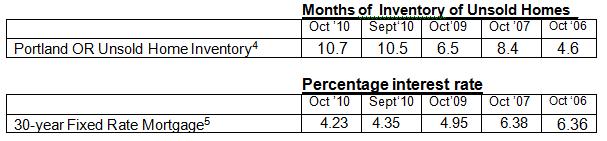

The purchasing power from Asia and other areas is welcome at a time when unsold home inventory continues to be too high and housing starts are at the lowest level that we have seen since April 2009.

The Federal Government’s new quantitative easing program of purchasing Treasury bonds will be going on, over the next several months. It is an effort to prevent deflation and is supposed to have the effect of lowering interest rates. So far it has not worked as was expected, but the program is just getting started. October’s mortgage interest rate is down, but that is just prior to the quantitative easing program. October may prove to be the low mark for interest rates. It looks like November will show a rise in mortgage interest rates. In the current climate, a leveling off of inflation and interest rates may be the best the quantitative easing program can accomplish.

Don “DR” Johnson, owner of DR Johnson Lumber Company, headquartered in Riddle Oregon, passed away this week. DR built a successful company of wood products manufacturing, timberlands, and ranching on the west and east sides of Oregon. The family continues to operate the mills and Valerie Johnson, who has background in lumber sales, became President of the mills as DR pulled back from active management. DR has been a major player in the timber industry through the operation of businesses which provide family wage jobs, as well as revenues that have flowed to local communities. He was a tireless supporter of the timber industry as a whole, in its efforts to assure a stable supply of timber and healthy wood products economy for rural communities. He also made substantial charitable contributions to the communities where the company has operations. Few have been as single handedly dedicated as DR to community service, and he inspired many others to follow in his footsteps.

Data reports used with permission of:

1Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3 Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, annually adjusted. Current report is for the prior month. Recent reports are often revised in bold from the prior month. All of ’08 and ’09 were again revised in May 2010.

4Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

Issue #3-11. © Copyright Rick Sohn, Umpqua Coquille LLC. For permission to reprint for nominal fee, Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.