By Rick Sohn,

Umpqua COquille LLC

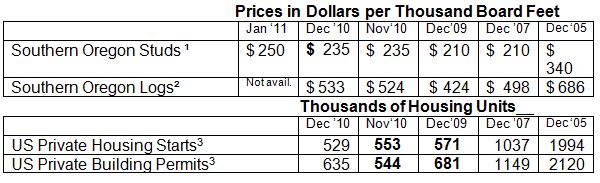

Strength continues in lumber and log prices. Building permits took a large jump. See below for details and a six-year span of prices and analysis of lumber, logs, housing, and mortgage stats.

Interpreting the trends.

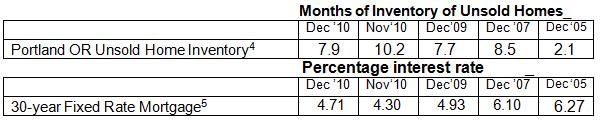

With building permits up 91,000 studs up $15, and logs up slightly, there are more signs of improvement. Mortgage rates did go up considerably, but are still very cheap historically. Ironically, the housing starts number of 529,000 is the lowest of 2010. But, if the permits level turns into starts in the next couple of months, we should see an uptick.

The strong markets continue to center on the strength of China, which is not waning. In both logs and lumber, it is squeezing supply, and creating the market strength. Domestically, Jobs have not improved, and foreclosures now are the result of unemployment and displacement, rather than defaulted loans and overvalued homes.

December 2005 is used for comparison this month – a span of 6 years. For perspective, Dec 2006 has only 1,638,000 building permits issued, a drop of 23% from December 2005’s level of 2,120,000. It has been almost 5 years since we have seen either starts or permits over 2 million. 2006 was a year of other dramatic changes as well. Logs went from $709 in January to $597 in December. Lumber went from $355 down to $230. Unsold inventory went from 3.2 months, up to 4.5 months by December, and 6.2 months by January 2007, 13 months later. So, 2006 was the year we started dropping into the recession in the wood products industry. The downward trend would continue to deteriorate until mid-2009. The downward market lasted 3 years. The recovery is only about 1 ½ years old and very slow, albeit improving.

The next couple of months, as we move into spring, will tell us a lot about how our domestic market is doing.

Data reports used with permission of:

1) Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2) RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3) Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, annually adjusted. Current report is for the prior month. Recent reports are often revised in bold from the prior month. All of ’08 and ’09 were again revised in May 2010.

4) Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5) Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

Issue #4-1. © Copyright Rick Sohn, Umpqua Coquille LLC. For permission to reprint for nominal fee, Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.