Timber update

By Rick Sohn

Umpqua Coquille LLC

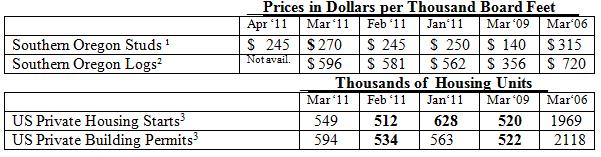

So far this Spring, housing starts took off like a……tortoise. But, home inventories are dropping and 30-year mortgage interest rates are still below 5%. It’s a good time to buy a house!! See below for details and a six-year span of prices and analysis of lumber, logs, housing, and mortgage stats.

More information and interpretation.

The Spring lumber purchase surge appears over. Domestic demand for wood products just cannot support high lumber prices, so they are weakening. While there is marked improvement in Housing Starts and Building Permits since February, they are still in the 500 thousands, and some analysts now expect them to stay there, or not get above 650,000 during 2011.

Although log prices reported for March are up, we can expect to see log prices drop, as we move into drier weather and onto dry-weather roads. The winter supply of logs is only available from limited rock road systems. Even with off shore demand, log prices may also be nudged down by the lumber prices.

Home sales have improved, as realtors tell me they are much busier, with more people looking, and more home sales closing. This activity is matched by the decrease in unsold inventory in Portland. Interest rates remain favorable as well, but what will happen after the federal “quantitative easing” program ends, is unknown.

Banks are still metering foreclosed homes into the market. There is also an unknown pent up supply of homes that will be listed over time. These factors will continue to keep the unsold home supply up. We are still looking for 2 consecutive months averaging below 7% for unsold home inventory in Portland before we can say there is a substantive decrease in unsold home inventories.

Data reports used with permission of:

1) Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2) RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3) Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, seasonally adjusted, annual rate. Current report is for the prior month. Recent reports are often revised in bold from prior months.

4) Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5) Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

Issue #4-4. © Copyright Rick Sohn, Umpqua Coquille LLC. For permission to reprint for nominal fee, Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.