By Rick Sohn

Umpqua Coquille LLC

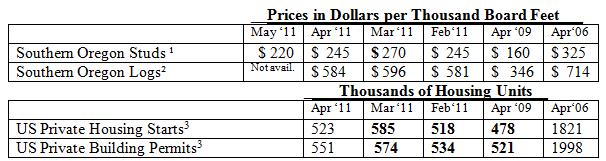

China’s 10-12 million housing starts per year, is one of the few bright spots on the horizon, compared to USA’s 523,000 this month. And mortgage rates remain attractive. See below for details and a six-year span of prices and analysis of lumber, logs, housing, and mortgage stats.

More information and interpretation.

More information and interpretation.

China’s demand for logs pushed the price up as much as $100 above expected domestic log prices, according to one source, really putting the price squeeze on local mills trying to acquire logs. The drop in stud prices was greater than the drop in log price in the last few months, continuing the squeeze. Fortunately this is abating, as others supply logs to China and log prices fall as we enter this slow-to-come summer.

China’s appetite for logs and wood products was highlighted by Allyn Ford in his annual Chamber of Commerce “State of the Timber Industry” presentation. It is driven by 10-12 million housing starts in China per year, according to Paul Boardman in “China’s Building Boom.” (http://www.forestprod.org/internationaltrade06boardman.pdf ) He further adds that by 2015, half the world’s new building construction will take place in China. One third of all Chinese will move into a new home in the next decade. Very sobering statistic –USA housing starts are currently only 5% of the level in China!!!!

Domestic mills, especially some of those close to Pacific ports, have ramped up worldwide export shipments. US softwood lumber exports in the first quarter, have doubled in the last year, to 233 Million Board Feet, according to Random Lengths. Further, worldwide Canadian exports reached 1.13 billion board feet in the first quarter, up 50% from a year ago. As a portion of this, US exports to China in the first quarter, are up 5-fold from last year, and Canada’s China export has doubled in the same period.

Outside of Swanson Group, most local operators produce almost exclusively for the domestic market. But the shipments overseas by others ease the competition for local mills selling into the domestic market, in this time of lackluster US demand. The increased worldwide capacity for lumber products is very helpful locally.

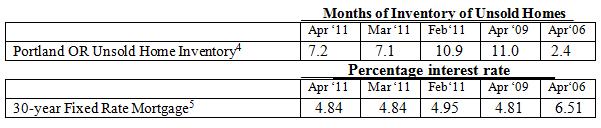

Housing starts and building permits remain way too close to their 2009 lows. Unsold inventory has shown unremarkable progress, with the “shadow inventory” (homes not on the market due to the price) remaining a concern. The only bright spot is continued low mortgage rates.

Data reports used with permission of:

1) Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2) RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3) Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, seasonally adjusted, annual rate. Current report is for the prior month. Recent reports are often revised in bold. Also, major revision made each May, reaching 21/2 yrs back.

4) Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5) Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

Issue #4-5. © Copyright Rick Sohn, Umpqua Coquille LLC. For permission to reprint for nominal fee, Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.