Rick Sohn

Umpqua Coquille LLC

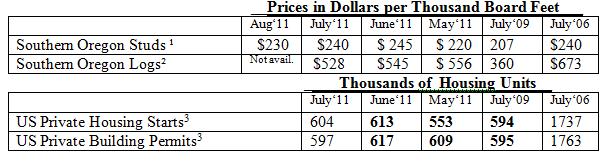

Our snail’s pace recovery is faltering with most indicators giving up 2 months or more of gain. See below for details and a six-year span of prices and analysis of lumber, logs, housing, and mortgage stats.

Information and interpretation.

Last month’s newsletter highlighted the snail’s pace crawl out of the depression in wood products. This month we are experiencing world-wide stock market events and banking, and other problems that threaten the broad recovery. The statistics tracked here have lost ground as well.

We gave back 2 months of recovery in building permits, a month in housing starts, 2 months of unsold home inventory, 2 months of stud prices, 7 months of log prices. From now through the end of the year there is often a slow-down in building and prices, so much of this would not be surprising, except that we are at such a low level to begin with. It seems that a continued recovery could have happened, but didn’t. The largest concern is the increase in unsold inventory, which is a larger drop than it should be at this time of year.

In a more ominous sign, Swanson Group sold its Noti sawmill to Seneca Sawmills of Eugene, probably for a bargain price. News reports indicate that Seneca will keep the mill operating with 120 employees. Lets hope that’s long term. This change is indicative of the length of the depression in Wood products.

Data reports used with permission of:

1) Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2) RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3) Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, seasonally adjusted, annual rate. Current report is for the prior month. Recent reports are often revised in bold. Also, major revision made each May, reaching 21/2 yrs back.

4) Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

Issue #4-8. © Copyright Rick Sohn, Umpqua Coquille LLC. For permission to reprint for nominal fee, Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.