Timber Industry Report

By Rick Sohn

Umpqua Coquille LLC

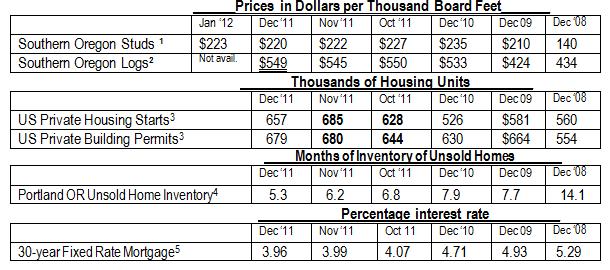

Most measures are relatively constant this month, except unsold inventory made improvement, driven by decreased listings. Interest rates continue down. Prices of lumber, logs, housing, and mortgage statistics below, show the four-year dilemma of painfully slow progress out of this deep depression in lumber and housing.

Information and interpretation.

This year, rather than track a good year from the prior cycle, such as 2006, our tracking starts with 2008, near the bottom of the lumber and housing depression, so as to show the pattern of business progression in this cycle. This approach emphasizes smaller changes in the statistics, and shows progress at a smaller scale. Compared to past cycles, volumes and price improvements today may seem insignificant, but they are what is happening month to month and year to year at this time.

Portland unsold home inventory has shown steady progress since 2008. According to RMLS, the number of newly listed homes is trending down, so unsold inventory is dropping. This decreases supply, stabilizes pre-owned home inventory, and ultimately stabilizes prices. Good news.

The interest rate for 30-year fixed rate mortgages are dropping steadily. The Federal Reserve has made it clear that their monetary policy through 2013 aims to keep interest rates low to help spur mortgage lending and other business. Interest rate alone cannot drive housing demand or other lending, when regulations, strict lending policies, uncertainty and unemployment, a lack of equity in their current property, and poor credit ratings, make it difficult for individuals to qualify for a loan.

Generally speaking, people took out building permits at a faster clip by 2009, but housing starts did not pick up until 2010. The December statistics actually exaggerate this trend, with housing starts not picking up until 2011. Studs picked up as early as 2009, but logs did not pick up until 2010. Logs tend to lag, but become complicated because their prices became driven partly by Chinese demand.

All said, there is some speculation that homebuilding will eventually improve. Homebuilding stocks are posting gains and outperforming the market, according to USA Today (Jan 16), despite predictions that foreclosures may increase this year. Driven by low prices and record low interest rates, Moody’s predicts a 37% increase in single family housing starts, and a 74% increase in existing home sales in 2012. Sounds great, hope it happens.

Others do predict only mild improvements as buyers wait to see home prices level out in some areas where they are still falling, according to the LA times (Jan 3). Home lending dropped from $3.3 trillion in 2005, to $1.3 trillion in 2011. Much of this was refinance. In December, 4 out of 5 loans written were for refinancing, due to the low interest rates, below 4%. In a nod to rentals, Morgan Stanley predicts that 2012 will be the ‘Year of the Landlord.”

Overall, we can expect some moderate improvement as the housing market stabilizes, consumer confidence begins to increase, and interest rates remain low. The magnitude of the improvement is the question.

Data reports used with permission of:

1) Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2) RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3) Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, seasonally adjusted, annual rate. Current report is for the prior month. Recent reports are often revised in bold. Also, major revision made each May, reaching 21/2 yrs back.

4) Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5) Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

Issue #5-1. © Copyright Rick Sohn, Umpqua Coquille LLC. For permission to reprint for nominal fee, Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.