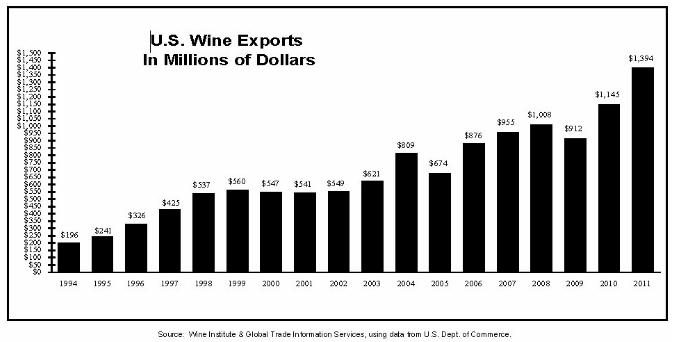

U.S. wine exports, 90% from California, reached a new record of $1.39 billion in winery revenues in 2011, an increase of 21.7% compared to 2010. Volume shipments were up 5.8% to 455.7 million liters or 50.6 million nine-liter cases.

“The quality, diversity and value of California wines have propelled us to another record year for wine exports,” said Robert P. (Bobby) Koch, Wine Institute President and CEO. “Our success in removing trade barriers and opening new markets as well as significant marketing investments by our wineries will allow us to reach our goal of $2 billion in exports by 2020.”

“Our global Discover California Wines campaign with its link to California’s iconic and aspirational lifestyle resonates with consumers, media and trade throughout the world,” said Linsey Gallagher, Wine Institute’s International Marketing Director. “We have significantly increased our focus on and investment in the China market over the past year in this top priority market. Our goal is to connect the lifestyle that is associated with our state with the understanding of California as a world class wine producing region.”

“Wine Institute’s work with the U.S. government and key international organizations such as the World Wine Trade Group, the Asia-Pacific Economic Cooperation and FIVS continues to have a valuable impact in facilitating trade. Export growth in 2011, however, reinforces the need to continue eliminating unreasonable trade barriers, particularly in the Pacific Rim where wineries are burdened by protectionist tariffs and duplicative regulations costing Asia-Pacific economies close to $1 billion per year,” said Wine Institute’s International Trade Policy Director Tom LaFaille.

Thirty-four percent of U.S. wine exports by value were shipped to the 27-member countries of the European Union, accounting for $478 million of the revenues, up 10% from 2010. Volume shipments to the EU reached 28 million cases in 2011, edging up 1.4% from the previous year. Other top markets were: Canada, $379 million, up 23%; Hong Kong, $163 million, up 39%; Japan, $105 million, up 39%; and China, $62 million, up 42%.

“California wines continue to grow in popularity with both trade and consumers in the Canadian market,” according to Rick Slomka, Wine Institute Trade Director for Canada. “Some of the recent growth comes from new brands with eye-catching labels and clever names. Also contributing to this growth is the ongoing strength of the Canadian dollar which has made California wines more competitive compared to wines from other major wine regions. Our continued success with premium wines in the Quebec market and in LCBO VINTAGES, indicates that Canadian consumers see good value in California at all price points,” said Slomka.

“In a challenging economy, the UK wine market does not stand still, and new sectors and opportunities have arisen. California has been responsive to these, and has built on the bedrock of its major branded wines with successes in the independent retail sector and on-trade outlets. Growth in these areas introduces our wines to new audiences, and enables California to demonstrate its diversity at higher price points. This growth is by no means exhausted, and augurs well for the future here,” said John McLaren, Wine Institute Trade Director for the United Kingdom.

“California wines fared well in most European countries. In Sweden for instance, sales growth of California wines were the highest of all wine supplying countries in Sweden. The story was similar in Germany, where California again experienced the highest growth rate of all wine exporting countries. However, a significant portion of California wine imported into Germany is re-exported and actually sold in other European markets. Additionally, as a word of caution, the 10% change in the Euro/Dollar exchange rate of the past few months may have an effect on exports to Europe in early 2012,” said Paul Molleman, Wine Institute’s Trade Director for Continental Europe.

“The outlook in the world’s emerging wine markets remains positive as most markets continued to post strong gains in 2011. Hong Kong remained California’s third largest export market by value, although growth slowed to 39% from 150% in 2010 compared to 2009. China’s growth remained buoyant at 42% compared to 2010 and is now the fifth largest export market by value, up two places from last year. Vietnam posted the strongest year-over-year gains (+266%) among the top 25 markets. Elsewhere, there is significant optimism in South Korea due to the recent ratification of the Korea-U.S. Free Trade Agreement and in Mexico where the 20% import tax on California wines was repealed in late October 2011,” commented Eric Pope, Wine Institute’s Regional Director, Emerging Markets.

“U.S. bulk wine exports to Japan have been growing as major Japanese importers are now importing popular-priced California wine brands in bulk and bottling in Japan. This reduces the burdensome import duty to a certain extent and makes inventory control easier. As per bottled U.S. wine, Japan is now importing more expensive California wines than in the past. Unlike other new world wine exporting countries, California wine is well represented at high-end restaurants because of our successful annual restaurant promotion,” reported Wine Institute Trade Director in Japan, Ken-ichi Hori.

Since 1985, Wine Institute has served as the administrator of the Market Access Program, an export promotion program managed by the USDA’s Foreign Agricultural Service. For more information, see: www.wineinstitute.org.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.