Timber Industry Report

By Rick Sohn,

Umpqua Coquille LLC

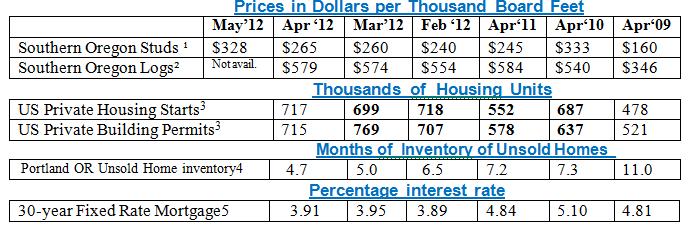

Spring stud prices popped, and unsold home inventory is the lowest in 5 years. Construction Starts and Permits are remaining above 700,000. Four-year trends of lumber, logs, housing, and mortgage statistics are shown below.

Information and interpretation.

There is so much good news, for depression-level business activity!

Housing starts and building permits are both above 700. Like last month, unsold home inventory in Portland dropped again, still to levels not seen since 2007. (2007 was a transition year in unsold inventories, ranging between 3.8 months near the beginning of the year, to 8.6 months near the end, and rising.) According to RMLS, New Listings are slightly up over last month. According to the Oregonian, Home Sales are up in every region of the US, although at 4.62 million, they are below the 6 million number that is considered healthy. Foreclosures in Portland have cut in half, lowest levels since 2007, although the new mediation law could push foreclosures higher in the next couple of months.

After only a one-month interruption, mortgage rates resumed a 7-month slide, and the final May numbers promise to continue the trend.

But the best news is the stud price, with a one-month gain of $63.00 per Thousand board feet. Several factors – including low retail inventories, low interest rates, continued stronger housing demand, and a major Canadian stud mill fire in April – all contributed. Local mills in Southern Oregon have responded cautiously, adding hours, but not shifts, in general.

If you read my reports closely, note that housing starts and permit numbers are all different this month, than last, because there is a major revision every May — this year, going back to Jan. 2010. For example, the March permits corrected up to 769,000 — a surprise.

Construction may, relatively, become the strongest part of the economy, as there is general concern on Wall Street about a recession, increased unemployment, and uncertainty surrounding the Euro, Greece, and other financially weak countries. Also, starts and permits below 1 million units generally create a deep recession, and we are still well below that number. The only reason things feel ok now, is that the local businesses have adjusted their output and employment levels to the low, albeit increasing, level of business activity.

Data reports used with permission of:

1) Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet generally for the second to last week of the month. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2) RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3) Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, seasonally adjusted, annual rate. Current report is for the prior month. Recent reports are often revised in bold. Also, major revision made each May, reaching 2 1/2 yrs back.

4) Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5) Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

Issue #5-5. © Copyright Rick Sohn, Umpqua Coquille LLC. For permission to reprint for nominal fee, Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.