By Rick Sohn,

Umpqua Coquille LLC

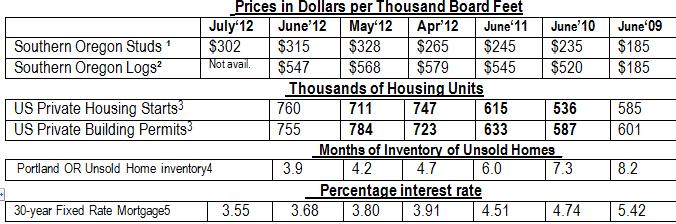

Too good to be true? This 2005-looking homebuilding boomlet is taking shape in July, 2012 at River Run, in Spokane, WA (see picture below). These houses are all sold. Four-year trends of lumber, logs, housing, and mortgage statistics are shown below.

Interpretation.

A picture is worth a thousand words. The recovery is back…… in a few select places. In fact there are 6 homes in a row under construction on this River Run street overlooking the Spokane River (only one of these shown is now lived in). Apparently once the first of these view lots sold a price was established. The others sold quickly and all began construction about the same time. Still, a good sign!!!!

This month’s statistics verify this picture of optimism. The mortgage rate is continuing to drive intense interest among those who can qualify, while lower unsold home inventories are pushing construction – more in some parts of the country than others.

Overall, housing starts and building permits continue to strengthen. Either starts or permits have posted a new high every month since January, 2012. Even better news for wood products manufacturers is that the price for studs has been more than half the price of logs for the last two months. This balance in favor of the mills has not happened since the first half of 2010. Even though prices for studs are down $10 in July, the key will be the log prices, which tend to weaken in the summer.

According to Janet Johnston of Prudential Real Estate, “Agents (in Roseburg, Oregon) are reporting that they are busy and…I have been very busy…my listings ARE getting shown, so I’m optimistic that we are going to get more properties sold this year. Can you believe the (interest rates)?…… Amazing!!! ….Potential Buyers…shouldn’t continue to ‘sit on the fence’ as the rates are going to start going back up, as soon as the market increases in activity…they are going to be disappointed that they missed these great rates AND the ‘bargains’ that are out (there)…. these days.”

Data reports used with permission of:

1) Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet generally for the second to last week of the month. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2) RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3) Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, seasonally adjusted, annual rate. Current report is for the prior month. Recent reports are often revised in bold. Also, major revision made each May, reaching 2 1/2 yrs back.

4) Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5) Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

Issue #5-6. © Copyright Rick Sohn, Umpqua Coquille LLC. For permission to reprint for nominal fee, Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.