Timber Industry Report

By Rick Sohn

Umpqua Coquille LLC

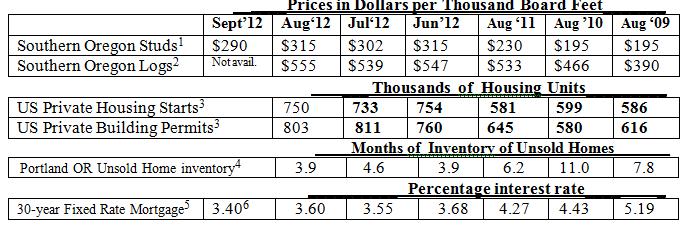

Housing starts are gradually improving, loan rates continue a surprising drop, but getting from offer to closed sale is still a high hurdle. Four-year market trends of lumber, logs, housing, and mortgage statistics are shown below.

Interpretation

For the last 7 years, the trend of July and August log prices continued into September. If August was lower than July, September was lower still. If August was higher than July, September was even higher. The trend (risky to predict!) suggests log prices will be reported higher next month. This would correlate with fire season closures this year.

While product prices bounce around July-September, stud prices continue strong in relation to logs, — over 50% of log price for the fourth month in a row… although they are down $25 this month.

Housing starts and building permits have been on upward trends this year, with either housing starts or building permits posting a new high each month of 2012, until this month. Still, fluctuation is less this month, and starts are up. The combined total of starts and permits did set a new record high for 2012.

Just when we thought mortgage rates could not get any lower, the changes in European and American monetary policies have pushed the interest rates lower. Low rates are not the whole solution to home buying, because banks are so skittish.

Janet Johnston in Roseburg, Oregon speaks for many as she discusses the challenge of getting a loan: “We are stabilizing here, but still struggling with appraisals – they are wild cards right now, never know where they are going to come in – some at or higher than sale price, others much lower (creating) a challenge to keep sales together.”

Last month this column reported that the end of the falling Mortgage rates may be near. Wrong. This just shows how difficult financial prediction is. Thanks to the increased availability of money through American QE3 and European Bank action as well, monthly average interest rates may not have hit bottom, based on this week’s number. It should come as no surprise that reports show people are refinancing 2 or 3 times, whenever interest rates drop as little as ½ and more commonly one percentage point.

Home sales continue to show strength in the Portland market, with 3.9 months equaling the lowest unsold inventory of the year. By comparison Roseburg Oregon has 9.5 months of unsold inventory, yet this is the lowest since before January 2007.

Data reports used with permission of:

1) Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet generally for the second to last week of the month. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2) RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3) Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, seasonally adjusted, annual rate. Current report is for the prior month. Recent reports are often revised in bold. Also, major revision made each May, reaching 2 1/2 yrs back.

4) Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5) Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

6Mortgage-X average of current month weekly rates.

Issue #5-9. © Copyright Rick Sohn, Umpqua Coquille LLC. For permission to reprint, e-mail [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.