By Rick Sohn, p.H.D

Umpqua Coquille LLC

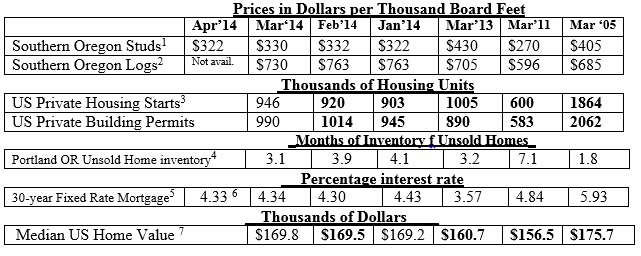

Prices are down some, and rental rates are up. This is not a very exciting Spring for wood products manufacturers. It would not take much to upset a fragile recovery. Recent lumber manufacturing, home construction, and housing markets from selected years are compared.

Interpretation and Looking Ahead.

This month’s report is lackluster. Spring is approaching. Yet, lumber and logs have started to drop – albeit from record log prices. Mill inventories are low as reported by Random Lengths, as they have been for the last 8 months. Any spark in demand would translate to a spark in price of studs, but there has been no such spark.

Likewise, housing starts and building permits have stalled, compared to the steady upward, albeit slow, trend of the last few years. Homebuilding is barely better than a year ago. The median price increase of homes has also slowed to a crawl, compared to the last couple of years.

Today, the Oregonian reported that home ownership in the US dipped to 64.8 percent, from a high of 69.2% in 2004. This is the lowest rate since 64.7% in 1995. In Portland, the home ownership rate is 60.9% and the rental vacancy rate is 3.1% is the second lowest in the nation, according to Census Bureau reports.

What will it take to increase home construction? A lower unsold inventory, as happened this month, helps. It will also take a fundamental change in the desire of current homeowners to sell. The Oregonian cited a Redfin report that 6 in 10 Portland area homes will not likely be put up for sale because owners do not have enough equity in their homes. Many more would not make enough on the sale of a home to have money for a down payment on the next home. USA Today reports that 17% of mortgages are still under water nationwide, relative to the mortgage amount. These homes will not sell anytime soon. While Redfin is predicting slow improvement over the next 5 years, increased mortgage rates would dampen the enthusiasm quickly.

Fortunately, mortgage rates have not increased much, or have increased very slowly. The European Central Bank could contribute to maintaining lower interest rates by starting a quantitative easing program –which helped keep US, interest rates low for years. In a global economy, this would have some influence on US interest rates.

Another grey cloud on the horizon: Watch for National legislation, the Johnson-Crapo bill, that replaces Fannie Mae and Freddie Mac. Although introduced in mid-March, its fate is uncertain. One report I saw, said that this bill would preserve the 30-year fixed rate mortgage, and introduce other affordable housing incentives. These incentives are crucial and worth watching closely. Analysts indicated that this bill may move in about 3 years (after the next Presidential election).

Either conditions change so that homeowners sell their current homes and build new ones, or more renters become homeowners again. Otherwise, the homebuilding market is not going to markedly improve.

Data reports used with permission of: 1Random Lengths. Kiln Dried 2×4-8′ PET #2/#2&Btr lumber. 2RISI, Log Lines. Douglas-fir #2 Sawmill Log Average, Southern Oregon region. 3 US Dept of Commerce. 4Regional Multiple Listing Service, courtesy of Janet Johnston, Prudential Real Estate Professionals, Roseburg, OR. 5Freddie Mac. National monthly average. 6Mortgage-X, national average, most recent week. 7Zillow.com, National Median home value. (http://www.zillow.com/or/) © Copyright Rick Sohn, Umpqua Coquille LLC. Issue #7-4. For more information or permission to reprint, please e-mail [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.