Timber Industry Report May 1, 2015

By Rick Sohn, PhD

Umqua Coquille LLC

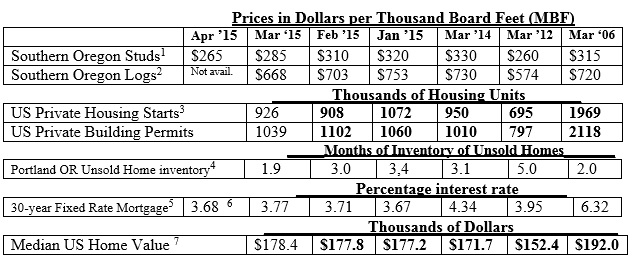

With disappointing stud prices, log prices, and housing starts, spring is weaker than expected, more like a premature summer. Low unsold home inventory and mortgage rates do offer promise. Trends of lumber, home construction, and housing markets, are compared to 2006.

Interpretation and Looking Ahead.

Log and stud prices are behaving like early summer, already. This reflects the dry weather which boosted winter log supplies, and the severe national winter weather which is turning into a slowly recovering spring across the country. Log prices continue their fall, from $758 in December, 2014, to $703 in February and $668 for March. Stud prices are also continuing a downward trend, from $352 in October, 2014, to $285 in March and $265 in April at the wholesale level, according to Random Lengths. This is the lowest level for studs in 3 years.

Furthermore, housing starts at 926,000 have not recovered to the levels of the last quarter of 2014, which were over 1 million starts. At least Building Permits are at 1,039,000 seasonally adjusted, although that is down from 1,102,000 in February.

Mortgage interest rates nationally continue to be very favorable, with the latest month at 3.77% and the last week of April at 3.68%. Median home values also continue to rise steadily, now averaging $178,400 nationally.

Unsold home inventory is 1.9 months in Portland, for the first time since 2005. These trends are reproduced in Roseburg, which as a rural community, does not have the economic brisk economy or the recovery that is taking place in larger cities. The unsold inventory has reached a low of 7 months, after double digits of unsold inventory have been the norm for pretty much the last 10 years. This pattern of tighter inventories of homes for sale, should eventually boost housing starts, for rural and urban areas.

The Mortgage-X statistics, used for the latest weekly mortgage interest rates in this report, was not accessible this week. Comparable statistic are readily available, and I am using the Federal Reserve Bank of St Louis Economic Research, for US 30-year Fixed Rate Mortgage, National Average, most recent week. These numbers seem comparable to previous Mortgage-X rates.

Data reports used with permission of: 1Random Lengths. Recent week Kiln Dried 2×4-8′ PET #2/#2&Btr lumber. 2RISI, Log Lines. Douglas-fir #2 Sawmill Log Average, Southern Oregon region. 3 US Dept of Commerce. 4Portland, Oregon Regional Multiple Listing Service, courtesy of Janet Johnston, Prudential Real Estate Professionals, Roseburg, OR. 5Freddie Mac. National monthly average. 6 Federal Reserve Bank of St Louis Economic Research US 30-year Fixed Rate Mortgage, National Average, most recent week. 7Zillow.com, National Median home value. (http://www.zillow.com/or/) © Copyright Rick Sohn, Umpqua Coquille LLC. Issue #8-4. For more information, questions, or permission to reprint, please e-mail [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.