By Rick Sohn, PhD

Umqua Coquille LLC

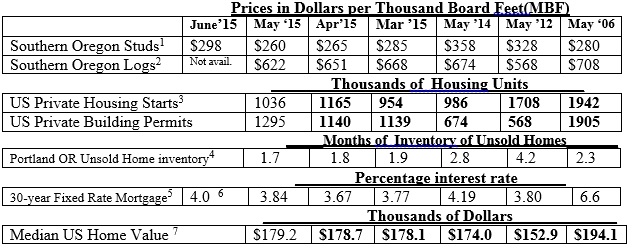

The wood products industry is churning along, even helped by lower log prices. A fall in housing starts should be temporary. A 3-4 year positive trend in housing recovery is predicted. Trends of lumber, home construction, and housing markets, are compared to 2006.

Interpretation and Looking Ahead.

You read it right. Studs are up $30, to 298, reversing a 7 month downward trend. A random lengths tracking of backup orders and unsold inventories has also turned in favor of unsold inventories last week, also for the first time in 7 months. This is a good sign. Log prices are down $29 to 622, but this is following seasonal trends and also favors manufacturers.

The contrast between building permits and housing starts is dramatic. Building permits rose by 155,000, a faster clip than any two-month rise since 2005 (granted, there were only 5 rising years out of the last 10). Housing starts are down almost as much as permits are up. Starts are down 130,000, to 1,036,000—still over one million. Such volatility in starts is more common, the last time being January to February, of this year, due to weather.

At the annual Northwest Farm Credit Services Forest Economics Symposium, economists were very optimistic about the next 3-4 years. They went as far as to say that housing would get out of its recession level of homebuilding, up to the 1.5 million range. They predicted that, in the process, homebuilding could again become a leading economic indicator. Generally, conference participants were very skeptical about this trend, but after the last 7 years, who can blame them.

Unsold inventory continues to be very favorable, now only 1.7 months in Portland. Mortgage interest rates, while higher, are only up to 4.0%. Median home values continue a steady climb.

In summary, every statistic favors the homebuilder, including the lower log cost and lower number of building permits. Next month could be very encouraging if robust trends continue. The only cloud on the horizon is a cloud of smoke, if a severe summer fire season materializes.

Data reports used with permission of: 1Random Lengths. Recent week Kiln Dried 2×4-8′ PET #2/#2&Btr lumber. 2RISI, Log Lines. Douglas-fir #2 Sawmill Log Average, Southern Oregon region. 3 US Dept of Commerce. 4Portland, Oregon Regional Multiple Listing Service, courtesy of Janet Johnston, Prudential Real Estate Professionals, Roseburg, OR. 5Freddie Mac. National monthly average. 6Mortgage-X, National average, most recent week. 7Zillow.com, National Median home value. (http://www.zillow.com/or/) © Copyright Rick Sohn, Umpqua Coquille LLC. Issue #8-6. For more information, questions, or permission to reprint, please e-mail [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.