By Rick Sohn, PhD

Umqua Coquille LLC

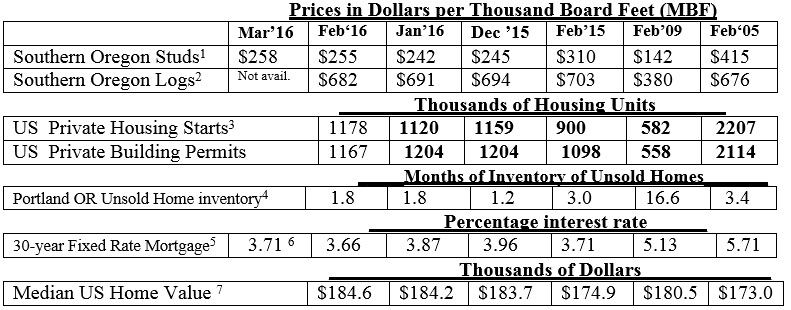

Housing starts, home values, and lumber are climbing only slowly, mortgage interest rates are the lowest in 3 years, and log prices peaked in January, so far this year. One southern Oregon mill closed, another cut production, and forest health management is stalled. Recent trends of lumber, home construction, and housing markets, are compared to 2009 and 2005.

Interpretation and Looking Ahead.

Yes, lumber prices, represented by studs are rising slowly, but are historically low. For perspective, February 2005 at $415 was an 11-year high. Weak lumber prices are one of several factors holding log prices $60-$70 below the winter highs of 2014 and 2015, which were some of the best winter log prices of the last 13 years. Also, the Canadian dollar is off a January dip in relation to the American dollar, but it remains historically weak.

The slowly increasing housing starts will be encouraging, if the trend continues. Looking back, the housing starts are up 30% from a year ago. Unsold homes inventory has stayed low, while interest rates continue to drop. And slowly, the median value of a US home has increased, while still below its historical peak of $195,600 in the spring of 2007.

Random Lengths also reports that there is progress on the US/Canada softwood lumber trade agreement that expired in October, 2015. This progress is directly attributed to the recent March visit of Prime Minister Justin Trudeau to the White House. A new proposal will not be on the table before October, 2016, due to established negotiation timelines.

Yet, despite this good news, the recovery is still flat, or worse, in the wood products business. Random Lengths reported that Swanson Group in Roseburg and Glendale has reduced its production by 25% and Rough and Ready Lumber has shut down for the second time in 3 years. The absence of timber supply is cited as a reason for these closures. But the problem goes both ways. Forests need processing facilities nearby, and processing facilities need predictable sources of wood.

According to Jennifer Phillippi from Rough and Ready Lumber, their shutdown has negative implications for the nearby Klamath National Forest in northern California. Rough and Ready’s sawmill and cogeneration plant would be important for the Klamath’s forest health program, if it were functioning. The Klamath National Forest changed from its thinning program for forest health to a temporary 100% salvage program following a 2014 wildfire. However, a lack of flexibility in agency regulations caused the substituted salvage sales to be held up in court and the wood has now lost its value through deterioration.

The Illinois Valley, where Rough and Ready Lumber Company is located, was also the subject of an October, 2014, study of thinning for fire resiliency, consistent with wildlife habitat needs. This study predicted that 28 Million Board feet of timber could be harvested per year, for the benefit of forest health. Yet, very little or none of this program volume has been harvested. This is another example of a failed relationship between nearby lumber manufacturers and potentially healthy forests.

Most timber stands on Federal lands in southwest Oregon dry forests need periodic thinning treatments to create stand resiliency to fire. Federal lands comprise 50% or more of many Western Oregon counties. Little, if any, of the necessary thinning gets done, despite plans and the best of intentions.

Individual agency rules and species recovery plans appear to allow appropriate harvests. Yet, the combined layers of their own and other agency regulations prevent the BLM and Forest Service from adequately thinning their dry forest stands. Without thinning, severe wildfires are inevitable, especially in Southern Oregon.

One issue is the conflict between short term and long term management strategies for the welfare of various threatened and endangered species. Due to certain guidance of the Endangered Species Act and species recovery plans, a long-term landscape approach is not implementable, and little or no management gets done.

A predictable path through this complexity of regulation is needed, for the improvement of forest health and decrease of summer smoke and wildfire. A predictable wood supply for local mills would be a welcome result of much-needed forest health management.

Data reports used with permission of: 1Random Lengths. Recent week Kiln Dried 2×4-8′ PET #2/#2&Btr lumber. 2RISI, Log Lines. Douglas-fir #2 Sawmill Log Average, Southern Oregon region. 3 Annualized monthly. US Dept of Commerce. 4Portland, Oregon Regional Multiple Listing Service, courtesy of Janet Johnston, Prudential Real Estate Professionals, Roseburg, OR. 5Freddie Mac. National monthly average. 6 Federal Reserve Bank of St Louis Economic Research, National Average, most recent week. 7Zillow.com, National Median home value. (http://www.zillow.com/or/). © Copyright Rick Sohn, Umpqua Coquille LLC. Issue #9-3. For more information, questions, or permission to reprint, please e-mail me at [email protected].

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.