By Rick Sohn, PhD

Umqua Coquille LLC

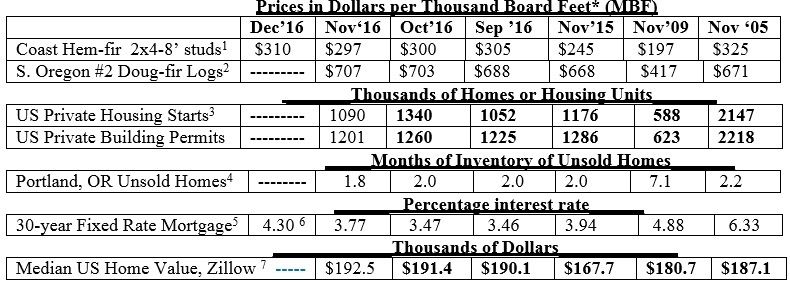

Interest rates continue a rapid rise, and last month’s good housing starts report turned out to be a bubble. Other than that, trends are positive or steady. Recent trends of lumber, logs, home construction, and housing markets, are compared to 2009 and 2005.

Prices in Dollars per Thousand Board Feet* (MBF)

* A lumber board foot measures 12 inches by 12 inches by 1 inch. The log board foot is based on an industry standard pattern for sawing straight boards from round, tapered logs. The leftover wood and bark become chips and sawdust, which are used for paper, fiberboard, and fuel to make electric power. In the Pacific Northwest two truckloads of logs make enough wood product to build a new home.

Interpretation and Looking Ahead.

The big story of the month, like last month, is interest rates. The Federal Open Market Committee raised the target for short term interest rates from 0.50 to 0.75%. This was only the second increase since 2006, which was prior to the Great Recession.

The Fed has forecast that there could be three additional interest rate hikes of 0.25% in 2017, but various news reports suggest that there might only be two, or even just one additional interest rate hike in 2017. Economic growth is not expected to be strong enough to warrant so many rate hikes. Some influencing factors: If Congress enacts a Trump tax cut next year, it could eventually improve the economy, while the shortage of labor could cause wage rate inflation. Increased deficits in the Federal budget could also push treasury yields higher.

According to Kiplinger’s mid-December forecast of interest rates, the 30-year fixed rate mortgage could rise to 4.6 percent, by the end of 2017. But with both the monthly average and the recent week rates already up about 30 basis points each (3/10 of 1%) in the last month, almost anything is possible. A mortgage interest rate of 5.0 percent by the end of 2017 may seem high today, but is well below the 5.6-6.3% range of 2005, before the slowdown of the Great Recession started.

Another important, but not surprising story this month is the apparent bubble of housing starts, two months ago. 2016 is shaping up barely better than 2015, with 9 of 11 months of 2016 higher than 1100 starts, compared to 7 months in all of 2015.

On the good side, unsold home inventories continue in the very healthy range, under 2 months in Portland. Nationally, building permits were level, and home prices continue to rise at a steady clip, as they have for the last 3 years. They turned around 4 years ago, starting at $151,600 in December 2011 and reaching an average of $192,500 last month.

Some related statistics as reported by Realty Trac in mid-November, 2016:

Remember underwater homes – where the appraised value was less than the mortgage amount? These homes pulled the national average home values down, and led to unusually high foreclosure rates. Its still a remnant factor with more than 20% underwater in some places like Las Vegas, Cleveland, Detroit, and Irvine, CA. Nationally, the seriously underwater homes (loan-to-value greater than 125%) is 10.8% (6,063,326 homes), down from 28.6% of US homeowners (12.8 million homes) 4 1/2 years ago, in 2012.

On a more positive note, Realty Trac also reports “equity rich” homeowners (where the value of the home is twice or more than the loan value) represents 23.4% of all US homeowners (total of 13.1 million). This is up from 18.8% a year ago. These statistics are steadily improving, along with the Zillow national home value, which we report. If you own a home, is it either underwater or equity rich?

Next month December statistics will be reported and close out 2016. Happy New Year to all!

Figures in bold adjust monthly. Data used with permission. 1Random Lengths. Recent week Kiln Dried 2×4-8′ PET #2/#2&Btr Hem-fir stud lumber. 2RISI, Log Lines. Douglas-fir #2 Sawmill Log Average, Southern Oregon region. 3 Annualized monthly. US Dept of Commerce. 4Portland, Oregon Regional Multiple Listing Service, courtesy of Janet Johnston, Prudential Real Estate Professionals, Roseburg, OR. 5Freddie Mac. National monthly average. 6 Federal Reserve Bank of St Louis Economic Research, National Average, most recent week. 7Zillow.com, National Median home value. (http://www.zillow.com/or/). © Copyright Rick Sohn, Umpqua Coquille LLC. Issue #9-12. For more information, questions, or permission to reprint, please e-mail me at [email protected].

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.