By Rick Sohn, PhD

Coquille Lumber

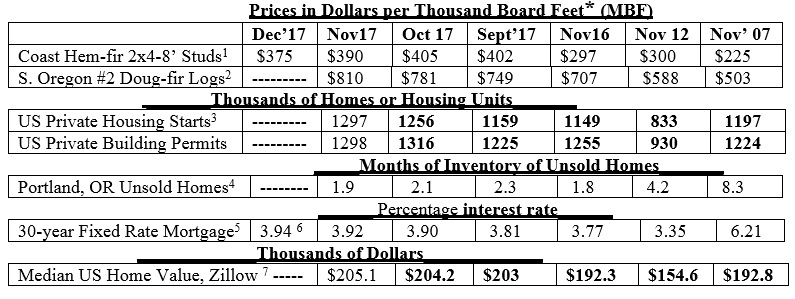

Log prices continue to rise, in record territory. Starts in single family homes are the highest levels in 10 years, per Random Lengths. Recent trends of lumber, logs, home construction, and housing markets, are compared.

* A lumber board foot measures 12 inches by 12 inches by 1 inch. A log board foot is based on the log volume required to recover a board foot of straight lumber from round, tapered logs, using industry standard sawing patterns that vary with log diameter. The leftover wood, bark, and sawdust, are used for paper, fiberboard, and electric power, but are not included in the log board foot measure. Two loads of Northwestern logs make enough lumber, panels, cabinetry, and other wood products to build a new home.

Interpretation and Looking Ahead

This a great moment to be in the log selling business, or a business supporter of logging. The #2 Mill Douglas-fir log price this month set a new record, at least since 2005, at $810. Sometimes, logs are sell above $900.

Stud prices are trending lower, month to month, while log prices are heading up month to month. While this is not a good trend, some strengthening of the product prices can be expected as we head into January and orders are filled for the Spring. As has been reported in this newsletter before, when the price of logs rises to over twice the price of lumber, manufacturers get squeezed. We will revisit the directions of these trends and the significance next month.

Housing starts, at 1,297,000 are the second highest annualized level in the last 10 years, with the exception of 1,328,000 in October 2016. More importantly, deeper statistics show, and Random Lengths reports, that a component of the housing starts, single family homes, is at its highest level in 10 years

The unsold home inventory, below two months, as well as the mortgage rate below 4 percent, and the continuing rise of median home prices nationally, are favorable indicators for home sellers and home ownership.

As reported last month, there are some grey linings to these silver clouds of high prices. The high prices are symptomatic of a general log shortage. And Random Lengths, indicates that some product purchasers will have to switch away from Pacific Northwest to other regions for their wood products, since there is not enough log supply to add a shift at mills in the Northwest, particularly the Southwest Oregon mills. One operator told me that this is the first time in his 40-year memory in the business that manufacturing capacity in the Roseburg area could not respond to higher product prices by adding a shift. There simply is not enough log capacity in the region, at present. Sustainably managing Federal lands for ecologically based harvest in place of fire could help mitigate the log shortage. Properly planned and carried out, this need not be an oxymoron.

(Figures in bold adjust monthly. Data used with permission. 1Random Lengths. Recent week Kiln Dried 2×4-8′ PET #2/#2&Btr Hem-fir stud lumber. 2RISI, Log Lines. Douglas-fir #2 Sawmill Log Average, Southern Oregon region. 3 Annualized monthly. US Dept of Commerce. 4Portland, Oregon Regional Multiple Listing Service, courtesy of Janet Johnston, Prudential Real Estate Professionals, Roseburg, OR. 5Freddie Mac. National monthly average. 6 Federal Reserve Bank of St Louis Economic Research, National Average, most recent week. 7Zillow.com, National Median home value. (http://www.zillow.com/or/). © Copyright Rick Sohn, Umpqua Coquille LLC. Issue #10-12. Permission granted to Oregon State University to reprint. For more information, questions, or additional permission to reprint, please e-mail Rick Sohn at [email protected].)

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.