Wall Street Journal Editorial,

Donald Trump and his advisers spent much of Friday telling everyone that the U.S. is not in a trade war with China, but investors weren’t buying it. Equity markets took a major header, falling by more than 2% across the board. Maybe investors are starting to look at the damage Mr. Trump may do to the Farm Belt states and to the GOP’s chances of holding Congress.

Mr. Trump raised the stakes late Thursday in his tariff showdown with Beijing, vowing to impose another $100 billion in tariffs on Chinese goods in light of its “unfair retaliation” after his initial $50 billion in tariffs. The latest target list still hasn’t been drawn up, and the silver-lining crowd is hoping that Mr. Trump was merely popping off as part of his negotiating strategy. Maybe that’s right. But then China popped off in return, saying it is ready to “forcefully” strike back if the new tariffs are imposed.

That’s the problem with protectionism. The other side can strike back, and businesses and markets don’t know when the politicians will decide to stop pounding their chests.

We’ve been warning since Mr. Trump first emerged as a candidate that his nationalist economics should be taken seriously. This is one policy he seems truly to believe in, he has empowered protectionist advisers, and previous Congresses have given a President wide latitude to act unilaterally. Trade was always the biggest economic risk of the Trump Presidency, and now we’re living through his punch-first policy as he tries to stare down Xi Jinping.

Mr. Trump doesn’t even seem to mind if the tariffs do some economic damage while he’s supposedly fixing the U.S. trade deficit. “I’m not saying there won’t be a little pain, but the market has gone up 40%, 42%, so we might lose a little bit of it. But we’re going to have a much stronger country when we’re finished,” the President told a New York radio show on Friday. Nice to know it will all turn out for the best.

Punishing America First

Meanwhile, much of that pain will fall on American agriculture, not least the Farm Belt states that Mr. Trump carried in 2016. Apparently he thinks he has them in the bag for 2020 as well, though he might want to reconsider if the tariff wars continue.

China targeted the $14 billion of U.S. soybean exports a year to China, about half of the U.S. crop, with a 25% tariff. Chinese consumers will pay more for pork because the beans are used mainly to feed pigs. But U.S. farmers will suffer more if Argentine and Brazilian soybean producers snatch American market share.

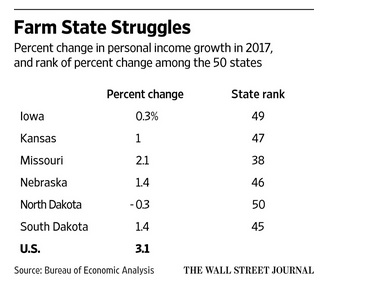

The financial hit would come at a rough time in the farm states, which have had to cope with low commodity prices for several years. The nearby table shows how several agriculture states underperformed in income gains last year. Iowa, which Mr. Trump carried by 9.5% in 2016, finished 49th out of 50. As a swing state that Barack Obama carried twice, Iowa could easily swing back in 2020.

Farm-state Republicans are beginning to notice. “China is guilty of many things, but the President has no actual plan to win right now. He’s threatening to light American agriculture on fire,” said Nebraska Senator Ben Sasse on Thursday. “Let’s absolutely take on Chinese bad behavior, but with a plan that punishes them instead of us. This is the dumbest possible way to do this.”

Someone in the White House seems to know the risks because its press shop spent Friday sending out missives telling farmers not to worry. Mr. Trump’s $100 billion tariff threat on Thursday included that he had told the secretary of agriculture “to use his broad authority to implement a plan to protect our farmers and agriculture interests.”

What’s Secretary Sonny Perdue going to do—buy up all the soybeans China no longer buys? Order farmers to slaughter their pigs to produce less pork that will also be subject to Chinese tariffs?

The basic economic problem with trade protectionism is that it is a political intervention that distorts markets. One political intervention leads to another, and the cumulative consequence is higher prices, less investment and slower economic growth.

Mr. Obama spent eight years interfering in the domestic economy for his political purposes, and the resulting slow growth was one reason Mr. Trump won. The Republican tax reform and deregulation have put the economy on a faster growth path, but Mr. Trump’s restrictions on trade, and on immigration amid a labor shortage, are threats to that progress.

China’s trade abuses need to be addressed, but Mr. Trump’s tariffs first strategy risks punishing America first. He—and we—had better hope Mr. Xi is willing to bargain.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.