By Rick Sohn,

By Rick Sohn,

Umpqua Coquille LLC

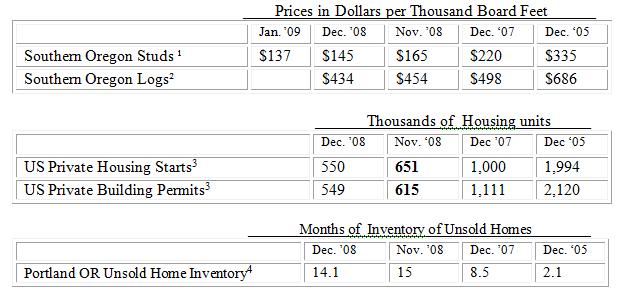

This is the second report in a series on the state of the economic health of southern Oregon’s Douglas County timber industry. Last month, prices for Studs and Logs, which affect the timber industry directly, were described in detail. This information is updated below.

In this column, statistics are added which indicate the future trends of demand and price in the southern Oregon’s Douglas County timber industry. Nationwide statistics have been selected because the diverse wood products produced in Douglas County, Oregon are sold throughout the nation, and nationwide demand for wood products affects Douglas County manufacturers. While reporting on factors affecting Douglas County, these trends are generally applicable to commodity wood producers in the Pacific Northwest’s Douglas-fir region, which includes western Oregon.

The housing starts and building permits statistics are developed each month by the Census Bureau in the US Department of Commerce. While more detailed information is available, the nationwide average provides a useful snapshot for our purposes. These figures are adjusted for seasonal fluctuations in volume, so different months of the year can be compared directly. In the most recent month, preliminary numbers are reported. Later revisions cause slight fluctuations from previous month reports.

“US Private Housing starts” is defined as the number of private individual single-family plus multi-family housing units where construction is begun during a specific time. They do not include mobile homes designed to be towed, and not requiring a foundation. As indicators of the economy, housing starts are considered a leading indicator, since the construction of a house begins a long process of purchasing, including home furnishings, that takes over a year to complete. The use of wood products occurs early in home or apartment construction, and coincides closely with demand.

“US Private Building Permits” is defined as the number of new privately owned housing units, both single- and multi-family, authorized by building permits in permit-issuing places. According to US Dept. of Commerce non-permit areas represent only about 2.5% of the total. Most, but not all building permits issued, are actually constructed. They are issued 1-3 months before construction begins. Building permits provide a predictable indicator of future residential construction volume.

The S&P/Case-Shiller Home Price Index was considered for tracking, but will not be reported regularly. First, the index lags 3 months, so the latest available figures to date are from October, 2008. Second, it does not seem that changes in home prices, while interesting, add much predictive capacity to the information provided by the combination of housing starts, building permits, and the unsold inventory. I would welcome comments on which statistics are the best predictors of future health of the timber industry manufacturing.

That said, the October, 2008 figures of the Case-Shiller home price index continue to show month-to-month drops for both 10- and 20-city national composites.

A statistic for the inventory of unsold homes is being used, because it provides a longer term indication of the future demand for wood products than does building permits. The Portland, Oregon unsold homes inventory, compiled by the Regional Multiple Listing Service, provides a useful indicator. The unsold inventory, in months, is calculated by determining the ratio of all active listings to all sales that closed during the month.

The trend of Portland unsold inventories in the Table above shows a dramatic change. Compare November and December’s 14- and 15-month inventories with the 2.1-month inventory of December, 2005.

The changes in all of these indices, not only between 2005 and 2007, but also between 2007 and December, 2008, are dramatic, and indicative of the depth of the economic hole we are in. Unfortunately, with respect to housing and wood products manufacturing, the unsold inventory numbers suggest that the end is not in sight.

According to a consensus of analysts reported in Random Lengths, January 9, 2009, housing starts are projected to drop to 741,000 units in 2009, a 20% drop from 2008. Recovery projected by these same analysts is only expected to reach only 900,000 to 1,000,000 units in 2010. This is not only dramatically low, but a slow projected turnaround, since housing starts from the last 40 years, starting in 1959, only dropped below one million units in 1980-82 (11 months), 1974-1975 (3 months), and 1966 (3 months). 2008 already saw 6 months below one million starts, and if the 2009 projection of housing starts holds, this will be the longest period below 1 million starts since the statistics were tracked.

This low current level of housing activity, compared to levels close to 2 million at the end of 2005, has further decreased demand for wood products. This has put additional downward pressure on both the regional product and log markets, which responded by dropping further. This trend means that output and employment in manufacturing facilities and the woods in Douglas County/Southern Oregon, and all of the Douglas-fir region, for that matter, will continue at low levels.

Data reports used with permission of:

(1) Random Lengths. 2”x4”x8’ precision end treated hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week.

One board foot measures 12 inches by 12 inches by one inch of product.

(2) RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Board feet are measured using the Scribner log scale.

(3) Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, annually adjusted. Current report is for the prior month. Recent reports are often revised from the prior month.

(4) Regional Multiple Listing Service RMLSTM . Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

© Copyright by Rick Sohn, Umpqua Coquille LLC.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.