Note from the Natural Resource Report:

Note from the Natural Resource Report:

I recently asked Rick Sohn, to share his background and perspective with a monthly report on the business status of the timber industry.

Rick recently retired as President and CEO of Lone Rock Timber Company, Rick has had a 27 year career with Lone Rock, a family company, which manages forests and sells logs to products manufacturers generally from Eugene and south in western Oregon. The company originally included Sun Studs, Inc. which was founded by Fred Sohn, and developed the first computerized sawmill in the world, in Roseburg. Rick has a strong Forest Biology background,in hos own right, including a Ph.D. from North Carolina State University. This was useful background in managing the company’s 120,000 acres of southern Oregon timberland holdings.

Each month, the column will provide key statistics showing the business trends of the industry, and some comments on a timber business issue. Rick’s column will provide a useful addition to our reporting on the timber industry. Since Rick is from Roseburg, the column will lean somewhat toward Southern Oregon, but be relevant to the statewide industry.

Timber Industry Report

By Rick Sohn,

It is a pleasure to start providing business information and commentary on the Oregon timber industry. Certain prices will be tracked monthly, and the first few columns will focus more heavily on introducing the tracking tools, which will be reported regularly. Subsequent columns will provide more varied commentary.

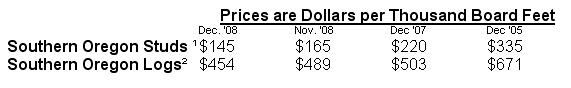

Each line in the table below gives a quick snapshot of the current health of the southern Oregon timber industry, when compared to prior year’s prices. Oregon manufacturers sell wood products throughout the United States, which causes the national housing market to have a major impact locally. In future columns, certain trends of the national homebuilding market will be added, to help predict future wood products business conditions.

The Studs price comes from Random Lengths, the industry standard for product prices. The Southern Oregon Studs price, published weekly, specifically reflects prices in Roseburg and the southern Oregon area, It is a good indicator of how southern Oregon mills are doing. This is the price of the coastal hem-fir 2×4 studs, 8 feet long. (Hem-fir is a mixture of hemlock, white fir, and other true fir logs). Studs are the vertical boards found in the walls of wood houses. They provide strength, as well as support for sheet rock and other wall components. This is a common locally-manufactured commodity.

The log price comes from the monthly RISI Log Lines report of Pacific Northwest log prices. Specifically, this is the price of Number 2 Sawmill Grade Douglas-fir logs, the most commonly traded log in the Roseburg area. It is usually between 12 and 30 inches in diameter (small end) with knots under 2 ½ inches in diameter. The price is reported for the Willamette Valley region and includes the Roseburg area.

While 2008 prices are the worst in years, both mills and log suppliers were already struggling, and losing money, in December, 2007. Only prudent management with experience in the cyclical timber industry allows companies to survive such downturns. Currently, the supply of studs exceeds demand, because mills are often hesitant to lay off shifts, and this pushes prices down even further. Most local area mills are family-owned, and do not lay off shifts, unless the business conditions are dire. The ongoing layoffs we have been reading about recently, are indications of very serious problems selling the product. That said, manufacturers and log suppliers are optimistic about a turn-around, but they do not agree on when it will be. This will be discussed in more detail in the future.

In the cyclical timber market, product prices tend to fluctuate more than log prices, as the above table shows. There are many reasons why stud prices drop further, percentage-wise, than logs. Even with lousy market conditions, there is local competition for logs, whereas for studs, there is excess supply for the construction demand. Southern Oregon contains the largest concentration of wood products manufacturing in the Pacific Northwest. Without log supply from the local Federal lands, where they were historically available, and with continuous improvements in local manufacturing, there are not enough logs from southern Oregon to supply Southern Oregon mills. While mills will buy whatever logs are the cheapest delivered to their plants, the extent of local manufacturing infrastructure is a good thing for long term local log demand.

Price reports used with permission of

(1) Random Lengths, 2”x4”x8’ precision end treated hem-fir studs from southern Oregon mills. Price is reported for the most recent week.

(2) RISI, Log Lines, Douglas-fir #2 Sawmill Log Average Region 5 price. Prices are reported for the prior month. Eg, December reports the prices for November.

© Copyright by Rick Sohn, Umpqua Coquille LLC. Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.