By Rick Sohn,

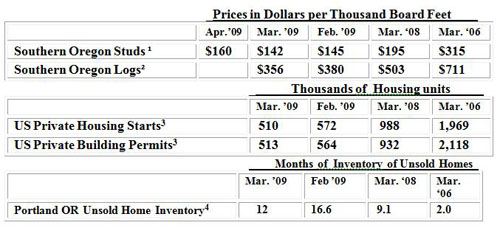

Housing starts and permits have fallen back again. See the 3-year price comparisons for lumber, logs, housing starts, permits, and unsold home inventories below. A profile of Keller Lumber Company, a Roseburg cedar mill, follows.

What the numbers mean.

In a nutshell, the encouraging signs are small, and the imbalances in supply-demand are still large. Homebuilding permits hit their lowest level at 510,000 units, eclipsing January’s low of 531,000. Housing starts also took a big step backward at 513,000, but did not recede to the January level of 477,000 units. Log prices lost another 6.7 percent, to $356, and log prices are expected to be down even further next month. While lower log prices will eventually reach a point where manufacturers are profitable, log prices this low are not sustainable. Many landowners are selling more logs than they would like, at low prices, in order to cover costs. The over-supply of logs on the market is pushing prices down.

The bright spots are Southern Oregon Studs, which have jumped to $160 from the $140’s of the last 4 months. Another bright spot is that unsold home inventories as measured by Portland, have fallen over 25%. Local real estate agents tell me they are a lot busier, due to historically low interest rates, commonly reported to be around 4.8%. It’s a good time to buy!

Profile of Keller Lumber Company, a Cedar mill near the Roseburg Airport.

I stopped by a couple of weeks ago and interviewed Dan and Blaine Keller, and Kirby Clark at Keller Lumber Co. I met with the Kellers in the main office break room, surrounded by sweets brought in by customers and employees. The unassuming plastic tables and chairs match the strong work ethic of this frugal, family-oriented operation. The company has survived innumerable downturns of the homebuilding business cycle, since they started, and this one is no different. Here is an introduction to their story.

Keller Lumber Company is located just over the hill that’s north of the Roseburg airport. It started as a Douglas-fir 2×4 stud mill in 1953. In 1979, at the recommendation of then middle-aged Dan Keller, they converted to become a specialty cedar mill. While much has changed, the stud mill beginnings shape their largest final product, a 4×4-inch post, 10 feet long.

In full production, 2 years ago, Kellers used 15 loads of logs per day of operation, and produced 21 Million Board Feet of products annually. Assuming a typical cedar plank deck with railing, about 16 x 32 feet, Kellers could supply close to 11,000 homes with outdoor decks every year. For efficiency, their sales are made only to large product distributors. This operation level required 2 shifts with 120 full-time employees.

For the last 18 months, Keller has run the sawmill, which produces rough lumber from the logs, only one shift, one day per week (Mondays), keeping just ahead of orders, with only 80 employees. The remanufacturing operations which produce the finished products, run Tuesday-Friday with only 20-30 employees on any given day. No new employees have been hired since August 2007.

The market and pricing of cedar logs and lumber is quite different than most commodity logs and products from Southern oregon, because the supply of Cedar logs is driven by the amount of Douglas-fir stands harvested. There are no pure cedar stands. Cedar is a by-product of the Douglas-fir stands, generally not exceeding 10% of volume. With Douglas-fir harvest down, cedar log availability is down too, “and we fight over the few cedar logs, pushing the price higher, and mills get squeezed.”

Thus, even with homebuilding down, there is still a shortage of cedar logs and products. Cedar log prices have not fallen to the extent of Douglas-fir, nor have product prices.

Cedar logs averaged $800/MBF in March of 2009, with prices as high as $1,075 as recently as September 2008, the all-time high price. Thus, the decline is only 25%, while Douglas-fir logs are down from $711, or 100% from their highs in 2006.

Likewise, product prices in cedar are down only 23% for 2×4’s ($815 in 2008 to $660 today) while hem-fir studs are down 63% (!!!) from a recent high of 428 in 2004, to $160 today.

While prices have not dropped so significantly, production has fallen off, and a lot of employees are laid off, with much less work time for those that remain. Kellers will have to re-gain their market share when volume does increase, with slim or negative profit margins temporarily. Keller Lumber Company is an integral part of the local lumber manufacturing industry. As with other family business manufacturers, Keller is committed to that future and is prepared to weather this downturn and the cost of re-entry into a stronger market when it comes.

Keller Lumber Company is a great example of a family-owned and family-run business.

Dan, Blaine and Kirby, who I met with, are 3 of the 9 relatives who currently work at Keller Lumber Company. Dan Keller, president and sales manager “sells every stick of wood in the mill.” 84 years young, he is full of stories about his days as a young timber faller in southern Oregon, in the early 1950’s, carrying a mechanically intricate 90-pound twin cylinder saw with a 7 foot saw blade (that’s why his back hurts today). Kirby and Blaine are cousins in their 50’s, Sawmill Superintendent and Crew Foreman, respectively. If anything were to happen to Dan, Blaine could “step in and start selling product tomorrow.” Mike Keller, another cousin, was not available the day I visited. He is the log buyer, also in his 50’s, and is active in industry affairs locally through Douglas Timber Operators.

Julia Keller, Dan’s wife, has been working in the front office full time for 50 years. John Keller, Vice-President and Dan’s brother, worked at Keller Lumber, until the year 2000, as the last privately employed log scaler in Oregon, specializing in Cedar logs.

Clarence and Olga Keller, Dan’s parents, were 4th generation in the sawmill business, when they started Keller Lumber Company at its current location in 1953. The family had been portable sawmillers in Wisconsin and Michigan “following the timber.” Dan and Julia learned their skills from Clarence and Olga. Mike, Blaine, and Kirby are 6th generation in the family business.

Keller’s goal is to remain a viable producer in the Roseburg area for generations to come.

Data reports used with permission of:

1Random Lengths. 2”x4”x8’ precision end treated hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week.

One “board foot” measures 12 inches by 12 inches by one inch of product.

2RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet are reported by standard log measurements using the “Scribner log table.”

3 Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, annually adjusted. Current report is for the prior month. Recent reports are often revised in bold from the prior month.

4Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Broker. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

© Copyright Rick Sohn, #2-4 Umpqua Coquille LLC.

Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.