Western Wood Products Association Economic Forecast

Western Wood Products Association Economic Forecast

Delivered October 12, 2009, to Oregon Forest Industries Council

By Rick Sohn,

Umpqua Coquille LLC

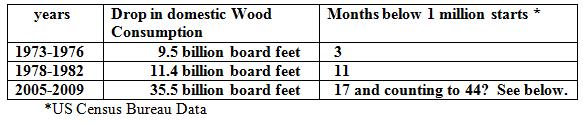

At the 2009 annual meeting of Oregon’s industrial forest landowners, the Oregon Forest Industry Council, Mr. Butch Bernhardt, Director of Information Services from Western Wood Products Association, spoke about the downturn in the wood products sector and the WWPA prognostication for recovery. Here are some highlights from his discussion, supplemented by additional data provided by Mr. David Jackson, Director of Economic Services for WWPA. To put our current downturn into perspective, note the drop in wood consumption in the United States in the 3 most recent downturns.

Based on a total 2005 consumption of 64.335 billion board feet, the total 2005-2009 drop was well over 50%!! As Mr. Bernhardt put it, this IS our great depression in the wood products industry. The driver is home building and remodeling, as home building consumes 45% of wood products, while repair and remodeling consume 35% of wood consumption. Together they account for a total of 75% of total wood consumption.

With housing starts currently less than 30% of the 2-plus million starts per month in 2005, it is not difficult to see why wood consumption is down.

Butch Bernhardt presented statistics on housing starts that went back all the way to World War II, rather than stopping in 1959 as with US Census Bureau statistics. The last time housing starts were as low as the current period was 1942-1945. In 1945, housing starts were 326,000. Yet, by 1946, there were 1 million starts. Nonetheless, housing starts did not get to 1.9 million until 1950.

Is a rebound similar to 1946 possible, sometime in the near future? Not likely. Why not? Back in 1945, there was NOT an inventory of unsold homes equivalent to 7.6 months supply, as there is today. Furthermore, we can expect the total foreclosures for 2009 to top 1 million, pushing the pre-occupied home supply out even further.

On the brighter side, Mr. Bernhardt reported that adjustable rate mortgages (translated subprime mortgages) totaled 35% of mortgages at its peak in 2005, while the number has dropped currently to about 10%, and new home sales have increased slightly since the first of the year.

Now that we know we are in a wood products depression that will be slow to mend, what does the future look like to the Western Wood Products Association?

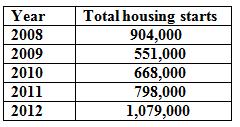

Total housing starts, the sum of single and multi-family units, is predicted by WWPA as follows.

There are no typos here. The housing starts are not predicted to reach 1 million units, single and multi-family, until 2012!!!!! If that is true, there will have been 44 months below 1 million starts, by January, 2012.

These numbers are best estimates only. However, this prediction is correlated with other projections, such as the forecast of domestic wood products consumption for 2012, of only 46.5 billion board feet. This is only 72% of the 64.3 billion board foot level of consumption reached in 2005, but well ahead of the 31 billion predicted for this year.

Are we likely to get to 1 million starts sooner than early 2012? As Mr. Barnhardt indicated, with a typical homebuyer needing 25% cash and pristine credit to buy a home today, don’t bet on it. We are in for at least a couple more years of very tough sledding.

When we see the recovery of homebuilding to 1 million units, what will the employment picture look like at that time? Without robust employment figures, it is generally accepted that we will not see a strong recovery. Furthermore, 1 million starts is far below the 2 million starts of 2005, another indication that a recovering economy is not necessarily a strong economy. According to the Bureau of Labor Statistics, the seasonally adjusted 50-state unemployment rate is still climbing and reached 9.8% in September.

Finally, in previous reports, we asked the question of when would we hit bottom or when would the recovery begin. In this report, we look into slightly later stages of the recovery. What is unpredictable this go-around, is the length of time between the beginning of the wood products recovery and the top of the market – or even the middle — of this depression-sized market cycle.

Thanks to Mr. Butch Bernhardt and Mr. David Jackson of Western Wood Products Association, for the data used in this report.

© Copyright Rick Sohn, #2-10 Umpqua Coquille LLC. Email:[email protected]

Information provided by Butch Bernhardt and David Jackson of Western Wood Products Association is gratefully acknowledged, and used with permission.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.