By Rick Sohn

Umpqua Coquille LLC

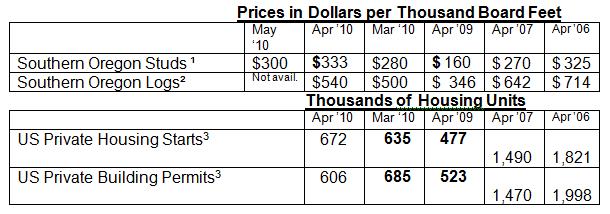

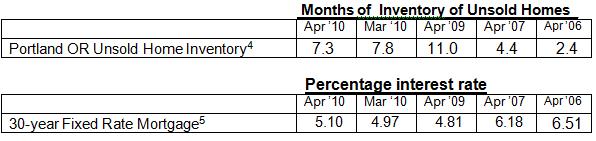

As we take a step back and reflect on the prices since April 2009, substantial percentage gains have been made in the lumber and housing statistics, while unsold home inventory has fallen. We’ve come a long way since the bottom of this great recession, However, relative to manufacturing and construction capacity, this recovery is anemic at best.

Interpreting the trends.

Lumber gave up some of last month’s extraordinary price gain, dropping $33 to $300, still a very strong number, relative to the level of housing starts we have now. The increase of log prices by $40 to $540 is not surprising, when considering the log prices in 2006 and 2007, relative to studs in the chart above. Some mills are buying multi-year logging contracts, but harvesting the trees within months of being awarded the sales, due to uncertainty about the product markets, longer term. They do not want to be stuck with overpriced logging contracts.

This skittishness is not at all surprising, given the month to month 10% drop in building permits. The continued historically high levels of unemployment and foreclosures continue to stoke the pipeline of homes for sale.

But there are some positive signs. The rise in housing starts in the last 2 months is a break from the 500’s or below throughout 2009, and the very low 600’s in January and February.

The drop to 7.3 months of unsold home inventory in Portland is an improvement. Showings and interest in buying are up, according to agents. But an unsold inventory of 6 months or more, is still characterized as a “buyer’s” market in Portland.

The mortgage rates have held surprisingly low, according to one banker I talked to. Now that the homebuyer tax credit has expired, he attributes it to the increased demand for these bonds, due to the weakness of the stock market. Mortgage rates were expected to increase, when the Housing Stimulus package expired in April. If the mortgage rates can remain near 5% it should certainly encourage buyers — the ones that have secure jobs.

Data reports used with permission of:

1) Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2) RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3) Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, annually adjusted. Current report is for the prior month. Recent reports are often revised in bold from the prior month. All of ’08 and ’09 were again revised in May 2010.

4) Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5) Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

© Copyright Rick Sohn, #3-5 Umpqua Coquille LLC. Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.