Timber Industry Report

By Rick Sohn,

Umpqua Coquille LLC,

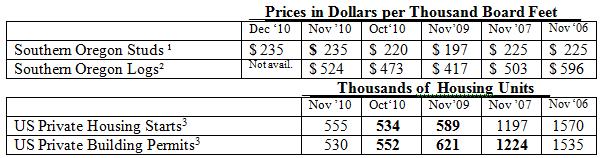

Log prices staged an 11% recovery, while studs held steady. Murphy Company opened the Rogue River plywood plant, anticipating recovery. Unsold inventory dropped slightly. These are good signs locally. See below for details and a five-year-span of prices and analysis of lumber, logs, housing, and mortgage stats.

Interpreting the trends.

One big news is that log prices are up 11% for the month. On the one hand, manufacturers are complaining about it, because their domestic product sales are not driving prices as much as Asia. However, several mills are now cutting for Asia, producing metric measure products, so they are benefitting somewhat from the Asian product demand.

The other big news is that John Murphy has re-opened up the plywood plant at Rogue River, employing 108 people, and hoping to move to 3 shifts as the markets slowly recover. This plant opening is really big news for Southern Oregon. Murphy Company purchased the plant earlier this year. It had been closed almost 2 years.

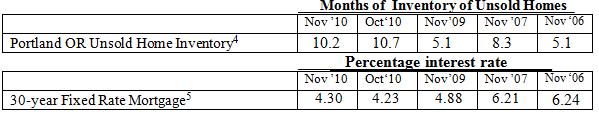

According to RMLS, unsold inventory in Portland is down slightly from November to October. That’s relatively good news, since it was up the prior 2 years, from October to November. Pending sales are also up. But in context, both new listings and closed sales are down since October, as well as average sale price. Mortgate interest rates are continuing to rise, but still are very low by historic standards, Lenders are still very cautions.

Despite the fact that housing starts are up 4% it is difficult to get excited about it, when building permits are down 4%. The non-domestic markets, mainly Asia, and China in particular, continue to drive prices. We have been in the 500,000’s of housing starts since December 2008. This level of demand for new housing seems to be the underlying demand, while unsold inventory remains so high. That said, projections for 745,000 housing starts in 2011 are reported in the context of the Murphy plant opening. Lets hope so, as foreclosures slowly fall.

Data reports used with permission of:

1) Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2) RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3) Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, annually adjusted. Current report is for the prior month. Recent reports are often revised in bold from the prior month. All of ’08 and ’09 were again revised in May 2010.

4) Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5) Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

Issue #3-12. © Copyright Rick Sohn, Umpqua Coquille LLC. For permission to reprint for nominal fee, Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.