Timber Industry Report which includes timber, lumber prices and a prediction on Oregon home values.

By Rick Sohn,

Umpqua Coquille LLC

Overall, the good news outweighs bad news. Some recent federal and international developments are reported. See below for details and a six-year span of prices and analysis of lumber, logs, housing, and mortgage stats.

More information and interpretation.

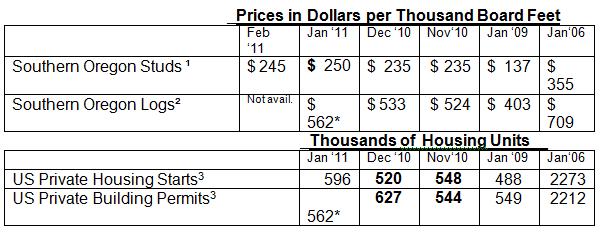

This month, I have changed the reporting format, to report the 3 most recent months, rather than two. Now that the numbers show a climb out of the recession –albeit very slowly — 2 previous years of numbers provide good benchmarks and show the length of the recession. 2006 is the year the wood products industry went from healthy to recessionary. 2009 was the worst year of this Great Recession.

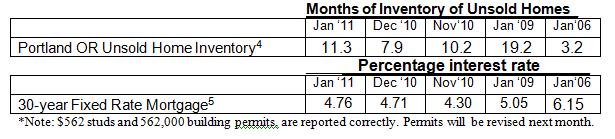

The Portland unsold home inventory, typically high at the start of each year, was 12.6 months in January 2010, making 2011’s unsold home inventory of 11.3 months, a year-to-year improvement. For January, both log and stud prices have increased nicely, although in February studs have dropped back, slightly. Fixed rate mortgages have leveled off.

The press picked up the increase in multi-family housing starts, while single family starts actually dropped very slightly. The bad news was not reported widely – that building permits have dropped off almost as much as starts increased.

There are some clouds on the horizon. Recently, as reported in the Financial Times and elsewhere, the Obama Administration and Congressional leaders have called for an end to Freddie Mac and Fanny Mae, government sponsored enterprises that support mortgages and a strong housing industry. Phased in over the next 5-7 years, the net effect may be higher mortgage interest rates, continued more stringent borrowing requirements, possibly an end to the 30-year fixed rate mortgage, and a gradually decreased percentage of the American population owning homes.

Random Lengths reports that a new sawmill with 170 Million Board foot capacity will open in Russia on the Chinese border next year. Random Lengths goes on to say that if this trend continues, and/or if Russia lowers its log export tariff, then China will increase imports from Russia, a natural trading partner, and the export of American and Canadian wood products and logs to China will decrease substantially.

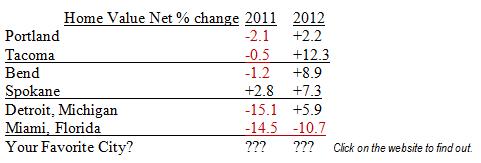

Finally, here is one of the latest websites that predicts what will happen to single family home values in cities and states, for 2011 and 2012. Go to http://cgi.money.cnn.com/tools/homepricedata/index.html?iid=EL . The relative differences between cities are interesting to note.

Every city I checked, is predicted to be better in 2012 than 2011. Most show a decreased value in 2011, averaging 5%, followed by an increased value in 2012 – with some notable exceptions. See Spokane, which is positive in both years, and Miami, which is negative in both years. Some cities, like Detroit, show wild, seemingly unlikely, swings predicted.

Data reports used with permission of:

1 Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2 RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3 Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, annually adjusted. Current report is for the prior month. Recent reports are often revised in bold from the prior month. All of ’08 and ’09 were again revised in May 2010.

4 Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5 Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

Issue #4-2. © Copyright Rick Sohn, Umpqua Coquille LLC. For permission to reprint for nominal fee, Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.