By Rich Sohn

Umpqua Coquile LLC,

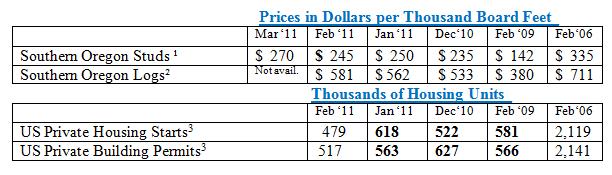

We are again near record LOW domestic housing starts and building permits, yet both Stud and Log prices increased? See below for details and a six-year span of prices and analysis of lumber, logs, housing, and mortgage stats.

The domestic fundamentals, like housing starts and building permits, are so bad, how can the market for logs and products be rising? There is broad consensus that we are climbing out of the Great Recession and will not fall back (except perhaps a typical mild recession in a couple of years).

Yet, the building permits number is the LOWEST (after various revisions by the Commerce Department) that we have seen in this Great Recession and since World War II.. The Housing Starts number is not much better, barely higher than the lowest number seen since World War II of 477,000 starts in April 2009.

These stats are corroborated by today’s Oregonian/AP article on new home sales, which hit a low of 250,00 for February, the lowest since records have been kept (starting in the 1960’s), and lower than the 323,000 homes sold last year. This statistic does not exactly match housing starts. A healthy number of new home sales would be only 700,000, compared to 1.8 to 2 million for housing starts. Nonetheless, it is reason for concern.

Another note: the first-time homebuyers tax credit that buoyed the market last year, ended April 30, 2010, and this improved closed sales through the middle of the summer.

In contrast to these alarming domestic housing statistics, lumber prices and logs are both higher. First, there is an upswing trend in prices that is typical for this time of year. Second, it is almost a broken record, but the increased prices are the result of demand coming from Asia, not only China, but now Japan, due to the earthquake and accompanying severe tsunami damage. Markets could feel this demand for a couple of years, once the nuclear scare is over, and rebuilding begins. If New Orleans can rebuild, surely Japan will rebuild with a vengeance.

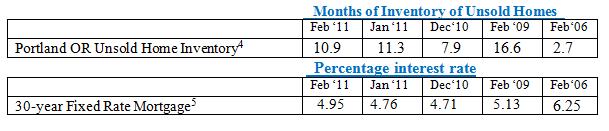

Fixed rate mortgages continue to rise, but are still attractive. The unsold inventory of homes on the market in Portland is continuing in the right direction, but real progress will not occur until we have 2 consecutive months of unsold inventory below 7 months, something which has not occurred since the middle of 2007. We saw unsold inventory dip to 7 months, 11 times since January of 2009. On appositive note, local builders I have talked to are busy, now, many with repair and remodel.

Data reports used with permission of:

1Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3 Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, seasonally adjusted, annual rate. Current report is for the prior month. Recent reports are often revised in bold from prior months.

4Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

Issue #4-3. © Copyright Rick Sohn, Umpqua Coquille LLC. For permission to reprint for nominal fee, Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.