By Rick Sohn,

Umpqua Coquille Company

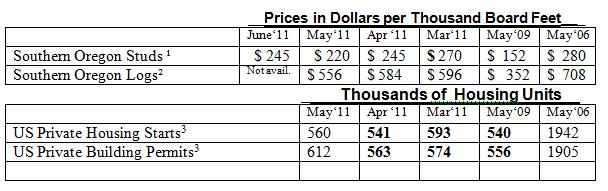

Lumber prices are rebounding and log prices are falling. Real estate agents report more activity, unsold inventories and interest rates are down, and a new softwood lumber promotion program is launching. Good basic news. See below for details and a six-year span of prices and analysis of lumber, logs, housing, and mortgage stats.

Information and interpretation.

Markets are slowly coming back into balance. Studs prices are rising and log prices are dropping, as the effect of exports eases, and the summer log supply increases. The Chinese effect on log price is down, because Chinese demand is still no match for the loss in domestic markets caused by our domestic Wood Products Industry Depression.

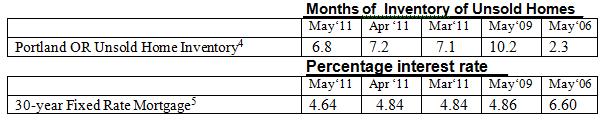

From a home buying standpoint, mortgage interest rates are dropping – I heard quotes around 4.5% for 30-year fixed rate mortgages this week, even lower than the May report. So, as reported here many times, for those who can afford it, this is an excellent time to find a dream home, or second home. Housing starts and building permits have come up some, but are still in the same price range as all of 2009 and 2010, mostly below 650,000 permits.

Realtors in Roseburg and Portland are telling me that transactions are on the rise, and by the end of July, one realtor’s sales will have exceeded 2010! And, buyers are going after more expensive homes, even above $500,000. But only those sellers willing to lower the price are selling, many in cash deals. Lets hope next month produces the second month in a row of unsold inventories below 7%.

Random Lengths reports that the North American softwood lumber producers and importers have approved a 35 cents per thousand board feet checkoff fee, to fund a softwood lumber promotional program. The fee will raise a total of $14 million per year to start. One of the targeted focuses of the program will be multi-story residential and non-residential wood construction. Additional information can be found at this site:

http://www.softwoodlumber.org/check-off/lumber-check-off.html

Overall, this is a good news month!!!

Data reports used with permission of:

1Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3 Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, seasonally adjusted, annual rate. Current report is for the prior month. Recent reports are often revised in bold. Also, major revision made each May, reaching 21/2 yrs back.

4Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

Issue #4-6. © Copyright Rick Sohn, Umpqua Coquille LLC. For permission to reprint for nominal fee, Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.