Oregon exterminator business thrives

By Oregon Employment Department [5],

Companies and Employees

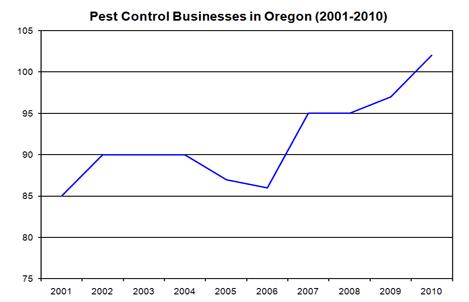

Oregon’s extermination and pest control companies are smaller than the average private company in Oregon with an average of 4.8 employees per establishment compared with the state average of 10.7. In addition to having few employees per business unit, there are relatively few employers in this industry in Oregon. In 2010, there were 102 extermination companies in Oregon (Graph 1), up from 85 in 2001. Almost 90 percent of those companies are clustered along the I-5 corridor in Western Oregon, which leaves few if any in the central and eastern part of the state (Bend in Central Oregon is the only exception).

For every 100,000 Oregonians, there are 12.7 extermination service employees; the national ratio is much higher at 30.5 employees per 100,000. This large disparity between state and national ratios is hard to explain. One explanation may be that Oregon does not have as large a bed-bug, rat, or cockroach problem as many other states have. Also, Southern states have warmer climates that are more conducive to pest population growth.

Seasonal and Economic Cycles

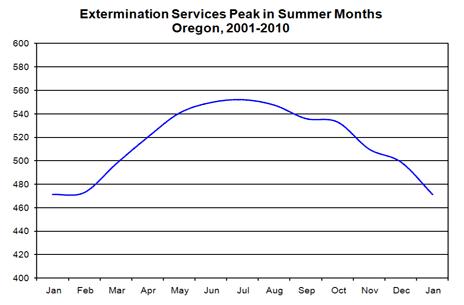

The extermination and pest control industry is cyclical, both economically and seasonally. The workforce drops along with the temperatures during winter months, losing 15 percent of industry employment. Seasonally, employment peaks in July and falls off to its lowest point in January (Graph 2).

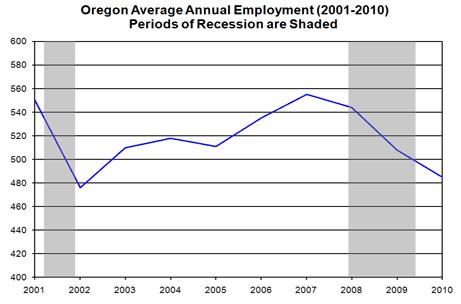

One might think that the need for pest control would be the same whether the economy was in an expansion period or during a recession, but the data suggests otherwise. During the last recession (2008-2009) and the one before (2001), employment in this industry had a large drop (Graph 3). Even if the need were there, many people may put off pest control services during periods of high unemployment since it may not be as high in the hierarchy of needs as food, housing, or transportation. Also, empty buildings, be they residential or commercial, probably don’t receive the same amount of pest control attention.

Graph 2

Graph 3

Pay and Growth

The average annual pay in 2010 for this industry ($34,700) is lower than the average private pay in Oregon ($41,000). Wages for Oregon pest control workers align closely with the national annual average of $35,700 for those in the extermination and pest control industry. Real wages in this sector have dropped slightly over the decade. Adjusted for inflation, average pay in 2001 was $35,200; therefore, real wages dropped by $500. This is slightly worse than the state average.

Oregon’s inflation-adjusted private pay in 2001 was $39,800, so real wages increased $1,200 since 2001.

Over the last decade, this industry has experienced contrasting trends. Even though the average number of businesses increased from 85 to 102 over the last decade, employment dropped from 550 to 485 over the same period. This lowered the average number of employees per business from 6.5 to the current 4.8.

Conclusions

As long as there are unwanted critters, there will be a demand for pest control services. New fears of bed-bug infestations and a growing demand for alternative methods and products will evolve the pest control industry. Demand for services will grow as the economy recovers from the last recession and demand for extermination services rise as more families can afford them.