By Rick SOhn

Umpqua Coquille LLC

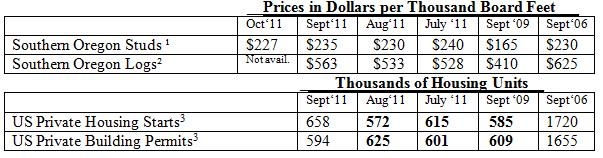

Housing starts picked up this month to the second highest number in 3 years. Will it repeat next month? Logs already made a typical mid-winter spike, driven by some shortages. See below for details and a six-year span of prices and analysis of lumber, logs, housing, and mortgage stats.

Information and interpretation.

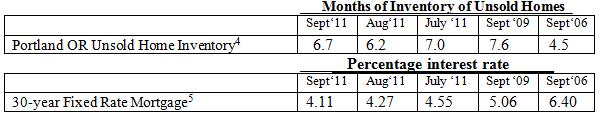

Housing starts picked up noticeably this month. With the exception of a one-month spike in April of 2010 (687) housing starts have not been this high for 3 years !!!!! — since October, 2008. Lets hope September 2011 is not another one-month trend. In other stats, mortgage rates are up only slightly, and unsold inventories are still under 7 months.

One other noticeable statistic this month….. the log price. Fall log prices normally fall through the end of the year, In contrast, in the last few years, August to September has remained relatively stable due to thinner inventories and the struggle to sell product. This year, a $30 price rise, similar to that seen in mid-winter, is already evident, driven by some log shortages at mills.

A comparison of log price to lumber price does suggest that log suppliers’ prices are in line. In September ’07 , logs were $561 and lumber was $225, very similar to today. What is out of line is September 2006, where lumber prices were relatively stable, but log prices were still falling. Lumber had reacted quickly to the change in market demand, but log prices were slower to come down.

I was at the Umpqua Community College Wine Institute today. There were two students using the de-stemmer to remove grapes from their stems. One was a displaced mill worker. The other, a displaced home construction worker. The timber and housing industries are still justifiably described as remaining in a depression, even with some small bright signs. We are better off than September 2009, with both logs and lumber were nearly 1/3 higher today. But two years later, recovery is not the way to describe this gain.

Data reports used with permission of:

1) Random Lengths. 2”x4”x8’ precision end trimmed hem-fir studs from southern Oregon mills. Price reported is Dollars per Thousand Board Feet for the most recent week. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2) RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table.”

3) Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, seasonally adjusted, annual rate. Current report is for the prior month. Recent reports are often revised in bold. Also, major revision made each May, reaching 21/2 yrs back.

4) Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5) Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

Issue #4-10. © Copyright Rick Sohn, Umpqua Coquille LLC. For permission to reprint for nominal fee, Email [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.