By Rick Sohn, PhD

Umpqua Coqullie LLC

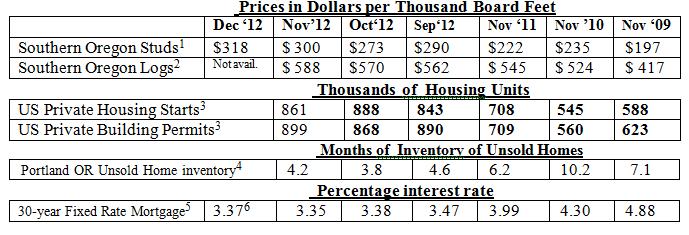

Continued strength in wood products and home construction, against a backdrop of a continued sluggish economy. Four-year market trends of lumber, logs, housing, and mortgage statistics are shown below.

Interpretation

Stud prices, and other wood building product prices, have been strengthening since October. Outside of a brief spike in 2012, the studs are the strongest since 2006. Their strength should be more sustainable this time. But log prices are also increasing, causing the manufacturers to comment. But no one is complaining too loudly about the improved business climate and volume of sales recovery, which is still in its infancy, at the still-historically low new construction rates. The recovery for manufacturers ranges from excellent to just fairly steady and cautious. Log prices are still historically low, but are rising quickly this winter. From what I have been hearing, I would guess that next month log prices tracked here could print above 600, which would be the first time in 5 years.

Since January, either housing starts or building permits has set a new high. This month is no exception, with a new high for permits of 899, which is the preliminary number. Could it break 900 for November when corrected next month? If so, that would be a first for either housing starts or building permits, since 2008.

The monthly 30-yr fixed rate mortgage rate posted another drop to 3.35%. The most recent week is up to 3.37%, could just be related to the end of the year.

Looking at the larger financial picture and in the post-election environment: In mid-December the Financial Times reported that the Federal Reserve plans to hold interest rates near zero while unemployment is above 6.5% (November, 7.7%), as long as interest rates do not rise above 2.5% (November, 1.8%). This connection between monetary policy and the state of our national economy is unprecedented. Further, in a third “quantitative easing” the FED also increased its purchase of mortgage backed securities from $40 billion to $85 billion per month, which is also slated to continue until unemployment drops significantly. These targets, designed to prop up the economy, have spawned speculation as to when interest rates would rise. The FED projects 2015. If unemployment continued to fall at the current rates it could reach 6.5% at the beginning of 2014. But many economists feel that 2015 or 2016 (or even 2018) is more likely, due to a projected rise in unemployment as those who had stopped looking for work, re-enter the workforce. Further complicating issues include, the fiscal cliff, a new middle east war, or unresolved eurozone issues. All of these actions and potential issues portend a continued slow rate of recovery.

Data reports used with permission of:

1) Random Lengths. Through Sept. 2012, 2”x4”x8’ precision end trimmed hem-fir stud grade from Southern Oregon mills. Starting Oct. 2012 the stud grade was consolidated with and is now reported as Kiln Dried Studs, Coast Hem-Fir 2x4x8’ PET #2/#2&Btr. Price reported is Dollars per Thousand Board Feet, generally the third week of the month. One “board foot” of product measures 12 inches by 12 inches by one inch thick.

2) RISI, Log Lines. Douglas-fir #2 Sawmill Log Average Region 5 price. Current report is for the prior month. Dollars per Thousand Board Feet of logs are reported using standardized log measurements from the “Scribner log table,” which includes expected saw trim. This is much larger than a product board foot.

3) Dept. of Commerce, US Census Bureau. New Residential Housing Starts and New Residential Construction Permits, seasonally adjusted, annual rate. Current report is for the prior month. Recent reports are often revised in bold. Also, major revision made each May, reaching 2 1/2 yrs back.

4) Regional Multiple Listing Service RMLSTM data, courtesy of Janet Johnston, Prudential Real Estate Professionals Broker, Roseburg, OR. Inventory of Unsold Homes (Ratio of Active Listings to Closed Sales) in Portland Oregon, for most recent month available.

5) Freddie Mac. Primary Mortgage Market Survey. 30-year Fixed Rate Mortgages Since 1971, national averages. Updated weekly, current report is for the prior full month.

6) Mortgage-X Most recent weekly rate of 30-year Fixed Rate Mortgages, national average.

Issue #5-12. © Copyright Rick Sohn, Umpqua Coquille LLC. For permission to reprint, e-mail [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.