By Rick Sohn, p.H.D

Umpqua Coquille LLC

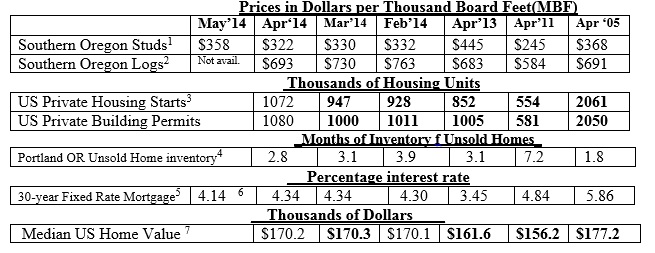

Spring has finally sparked some recovery in wood products. Not a big spark, and none too soon. Mortgage rates are trending down, homebuilding is trending up, and new uses of wood are in the works. Statistics from recent years for recent lumber manufacturing, home construction, and housing markets are compared.

Interpretation and Looking Ahead.

The spring spark in lumber prices has finally happened, with an 11% increase since last month. Better late than never. The harsh winter, we are now finding out, caused the US economy to actually contract in the first quarter. But recovery should continue this quarter. This year’s spike in lumber price is lackluster, compared to 2013’s $445/MBF.

As expected in the spring, log prices have gone down, with a 5% drop since last month, to $693. The improved spread between lumber and log prices is good news for mills. Without making some money and continually upgrading their facilities, manufacturers fall behind.

Housing starts and building permits are showing signs of life. March’s Permits corrected upward from 990,000 to an even million units, makes the housing picture look better. April results are only the second month since 2008 that both Housing Starts and Building Permits are both over 1 million (the other month was Nov. 2013).

Mortgage rates have also stopped rising. In fact the latest weekly number shows quite a drop, to 4.14%. Next month should also show a drop. Unsold inventory of homes is also improving.

Last month’s precaution about the potential direction of the economy is mitigated by this month’s statistics and an understanding of the overall weak US economy in the winter. However, conditions are still slow to improve, and many homes are valued too low for the owners to sell. Median home prices have lost their spark and leveled off in the last few months.

Some encouraging developments: At the Oregon Society of American Foresters State Convention, held at the beginning of May, Oregon State University officials indicated that the OSU Forest Products Research Lab has developed a working relationship with the University of Oregon School of Architecture. One of the issues under discussion is to ensure that wood as a renewable green product, is recognized by various Green building codes, such as LEED. This is a significant collaboration.

The SAF convention also produced discussion of a relatively new product, “Cross Laminated Timbers.” CLT are designed to use wood for structural support in the construction of high rise buildings. Interest is based on wood properties, such as, the fact that massive wood beams are actually very slow to burn, greener to produce, and rated better than concrete or steel in earthquakes and fire.

In 2009-2010, an 8-story office building was constructed using CLT in Austria, and a 9-story residential building in London were completed. In 2012, a 10-story apartment building was completed in Melbourne. A 34-story building has been approved in Stockholm, and a 30-story tower is planned for Vancouver. Apparently, there is competition underway by architectural firms, to see who can build the tallest wooden structure using CLT or similar wood structures in high-rise construction. One west-coast name to follow in the use of wood in skyscrapers, is Michael Green, a Vancouver, B.C. architect.

The introduction of wood into structural components of condos and apartment buildings, would be a welcome new development. . It helps mitigate the trend of a lower percentage of homeowners in the US, which we reported last month, is now under 65%.

New uses of wood as well as greater recognition of wood in sustainable building codes, are welcome developments.

Data reports used with permission of:

1) Random Lengths. Kiln Dried 2×4-8′ PET #2/#2&Btr lumber.

2) RISI, Log Lines. Douglas-fir #2 Sawmill Log Average, Southern Oregon region.

3) US Dept of Commerce.

4) Regional Multiple Listing Service, courtesy of Janet Johnston, Prudential Real Estate Professionals, Roseburg, OR.

5) Freddie Mac. National monthly average.

6) Mortgage-X, national average, most recent week.

7) Zillow.com, National Median home value. (http://www.zillow.com/or/) © Copyright Rick Sohn, Umpqua Coquille LLC. Issue #7-5. For more information, questions, or permission to reprint, please e-mail [email protected]

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.