![]()

By Josh Lehner

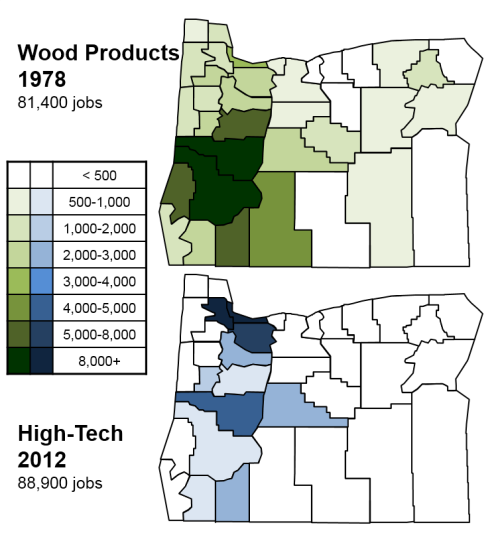

Oregon Office of Economic Analysis Blog

Oregon remains a natural resource and manufacturing state, which along with our strong migration patterns, are really the two distinctive features that sets the state apart from most others. However the nature of our goods producing industries has changed over the past 40 years. Previously our office has detailed historical trends in both the wood products industry and the high-technology industry. What follows below the fold is a short summary from our latest economic and revenue forecast of how these longer-run trends have effectively offset one another from a top line, statewide perspective. Of course, at a regional level these trends are not offsetting as the geographic footprint and impact of the industries is not the same.

.

Throughout most of the post-war period, Oregon’s agricultural producers and forest product firms have dominated local business cycle trends. In particular, as wood product firms underwent a painful restructuring, the wealth and earning power of Oregonians took a step backward, particularly in rural areas. Relative wages in the state have not recovered since.

Deep cutbacks among wood product firms during the early 1980s resulted in Oregon’s worst recession of the post-war period – job losses statewide were 50 percent larger than during the Great Recession. Oregon even suffered outright population losses during the early 1980s, something unheard of throughout the state’s history.

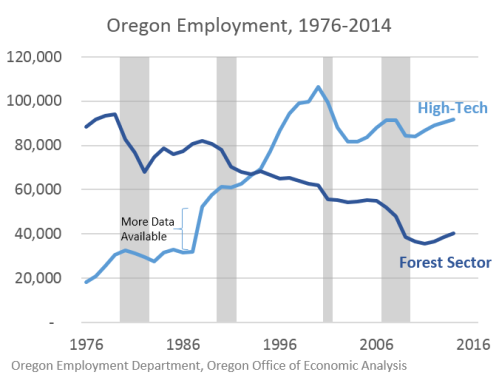

Timber industry job losses continued throughout the 1990s, as mills closed across the state. However some of the pain of these losses was muted by rapid population growth in many areas and also the rise of the high-technology industry.

During its darkest hour of resource industry job cuts, Oregon’s economy overall was rescued by an influx of young, skilled households. Many of which were drawn to jobs with expanding technology manufacturers. The flow of human capital up the Willamette stepped in to replace the waning flow of natural resources.

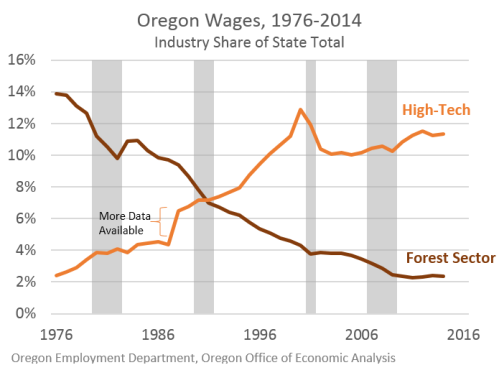

Currently, Oregon’s high-tech industry accounts for the same number of workers and nearly the same share of state wages as the forest sector did in the 1970s. Although the future role of technology firms that attracted these household remains somewhat uncertain, largely due to those long-run forces of globalization and technological change, the skilled workforce they brought and continue to bring and develop to Oregon will pay dividends into the future.

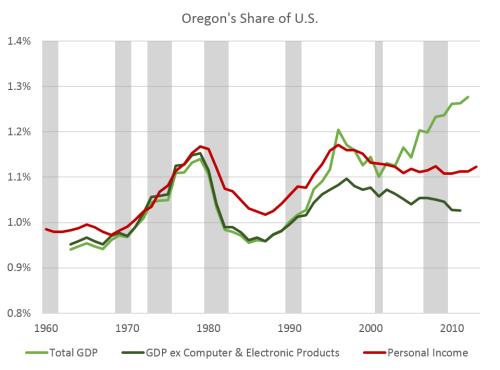

Given their high levels of productivity and need for ancillary industries, manufacturers and resource industries have an outsized impact on economic activity. Measuring that impact is a difficult task, particularly due to estimating the quality of rapidly evolving technology products and properly capturing all leakages of value outside of the state.

The divergence between growth in manufacturing output as measured by state GDP and growth in employment and wages highlights the economic value that is lost to other areas, or possibly measurement issues. While the share of economic output by the state’s high-tech industries has been increasing over the past decade, their share of wages and jobs is effectively unchanged. Even as many of the benefits of technology production – jobs and income in particular – are being realized locally, it also is apparent that not all are.

Overall the near-term outlook remains bright. So far in recovery the forest sector has added approximately 4,500 jobs and the high-tech sector 8,300. Longer term prospects are somewhat unclear. Along with an improving housing and construction market will come more demand for both the state’s raw logs and wood products. The remaining portions of the industry will likely fare well, however the ongoing issues and potential federal legislation make the exact nature of the industry moving forward unknown.

In terms of high-technology, the differences between the hardware — Oregon’s strength — and software — where the growth is — portions of the industry represent both a challenge and an opportunity. Manufacturing output and productivity will continue to increase, bringing gains to Oregon’s high-technology producers, however expectations for employment gains over the next decade are minimal. Growth on the software side of high-tech is expected to remain quite strong, however Oregon is not a clear-cut leader here, like the state is on the hardware side. Industry trends are such that high-tech will continue to grow as a share of the state’s employment, however the growth will be concentrated in software related sectors.

All told, both the forest sector and high-technology industries will continue to play a pivotal role in Oregon’s economy. However the outlook for both is somewhat unclear.

Addendum

As mentioned at the start, the geographic footprint of these two major industries is, and was, not the same.

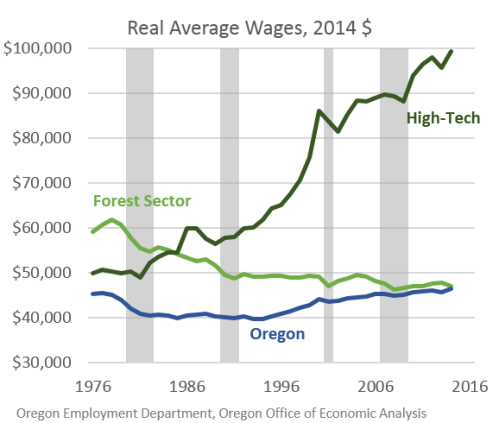

Lastly, one important aspect are wages. As discussed in our office job polarization report last fall, not only have wood product jobs, and the forest sector more broadly, fallen by half to two-thirds, the average wage has declined as well. Back in the 1970s, the typical forest sector worker earned a wage nearly 40 percent higher than the statewide average. Today, that same industry employee earns just about the state average. On the opposite end, wages for high-tech workers continue to increase, faster than most other industries and much faster than the rate of inflation.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.