State Senator Herman Baertschiger Jr. aims to liberate rural communities from the tax death trap.

State Senator Herman Baertschiger Jr. aims to liberate rural communities from the tax death trap.

By Taxpayer Foundation of Oregon

State Senator Herman Baertschiger is bringing to light the tax death trap that rural Oregon is facing. The trap is that rural counties cannot grow due to deadlocked failed land-use policies and what land is left faces increasing taxes and fees. Senator Herman Baertschiger is using Josephine County as the perfect example.

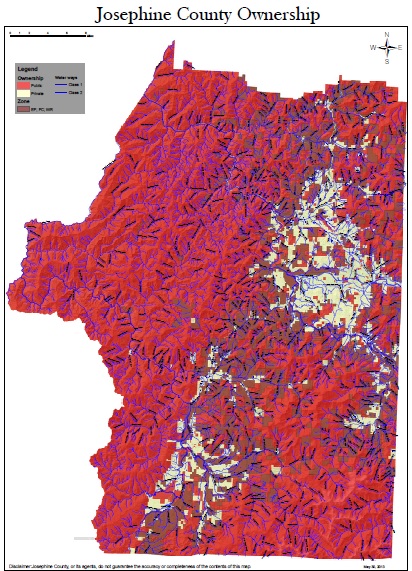

The attached map shows in red the vast amount of publicly owned land that is not producing property tax revenue. It amounts to 72% of the entire county. Upon inspection it gets worse. The map reveals that the brown mapped areas are land that is in special zones (EFU; exclusive farm use, FC; forestry commercial, WR; woodlot reserve) where property tax revenue is limited or reduced. The area in white is private land.

The chart shows how Josephine County does not have room to grow and does not have adequate room to expand its tax base. As rural counties have suffered the state’s worst unemployment rates and shrinking tax revenue growth, it also suffers from increases in state taxation. State Senator Herman Baertschiger, Jr. states, “Josephine County is just one example of what rural counties in Oregon are facing because of poorly implemented Federal land use policies.”

This is a tax death trap that rural communities face. It will not change until there are more choices and flexibility in Oregon’s land use laws.

(click map for larger image)

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.