By Rick Sohn, PhD

Umqua Coquille LLC

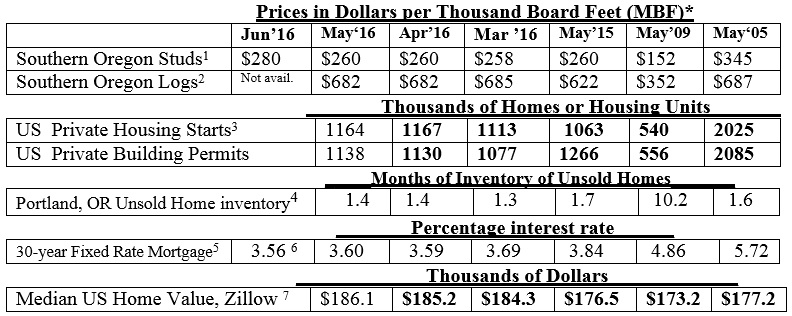

Stud prices are up and most statistics are favorable for the economy, despite the fact the housing starts remain unchanged. Further improvements are expected over the next 4-years. Recent trends of lumber, logs, home construction, and housing markets, are compared to 2009 and 2005.

* A lumber board foot is 12 inches by 12 inches by 1 inch. A log board foot is much larger, to account for losses in manufacturing due to round logs saw kerf, etc. The log remains become chips, which are used for paper and fuel.

Interpretation and Looking Ahead.

Random Lengths reports that the price of Studs has finally broken out of its slump and is up to $280, the highest price since August 2015. Order files are also firming up at the mills. This is happening despite the fact that lumber exports from Canada to the U.S. are inching up, since expiration of the trade agreement last October.

Housing Starts and Building Permits are flat. Yet, unsold inventory remains low in Portland and average home prices continue an upward trend.

Mortgage rates are still low and trending down. This is a reversal from last month when we discussed the expectation of another ¼% rise in interest rates. This is now unlikely, due to the instability in Europe and the vote for “Brexit,” Britain exiting the European Union. One Bloomberg radio report stated that Janet Yellen missed her chance to raise interest rates.

Log prices remain uncharacteristically steady, as reported last month. There is the potential for log shortages and uncharacteristically higher log prices in the summer than winter, caused by woods closures due to wildfires and fire danger. Lumber prices would probably remain steady or increase if there is a shortage.

Northwest Farm Credit Services held their annual Forest Products Symposium in June. They project a strengthening housing market and domestic consumption for the next 4 years, although 2016 may be disappointingly flat. This optimism is based on pent up demand and new family formation. Young adults, age 25-34 comprise the largest age-related segment (cohort) of the population at present. These are potential single-family home buyers.

If you have driven in rural southwest Oregon, particularly on Interstate 5 or other valley highways, you cannot help but notice the dead and dying trees, mostly Douglas-firs, some as old as 50 years or more. The red needles indicate dead trees, tops of trees, or branches. While global warming is happening, this dieback should come as less of concern than it might appear.

The areas with dying trees were historically oak savannah forests. These are the areas of this region with the lowest rainfall, and were historically dominated by oaks, and scattered Douglas-firs and other conifers. The drought of the last few years has caused a shortage of water in the soil in these areas. The firs are too crowded and mortality is due to the lack of moisture. Single branch mortality, which is caused by native beetle infestation, is also increased by drought stress.

Figures in bold are adjusted monthly. Data used with permission. 1Random Lengths. Recent week Kiln Dried 2×4-8′ PET #2/#2&Btr lumber. 2RISI, Log Lines. Douglas-fir #2 Sawmill Log Average, Southern Oregon region. 3 Annualized monthly. US Dept of Commerce. 4Portland, Oregon Regional Multiple Listing Service, courtesy of Janet Johnston, Prudential Real Estate Professionals, Roseburg, OR. 5Freddie Mac. National monthly average. 6 Federal Reserve Bank of St Louis Economic Research, National Average, most recent week. 7Zillow.com, National Median home value. (http://www.zillow.com/or/). *Unemployment statistics from the Manhattan Institute, http://economics21.org/html/long-term-unemployed-still-recovering-recession-1739.html. © Copyright Rick Sohn, Umpqua Coquille LLC. Issue #9-6. For more information, questions, or permission to reprint, please e-mail

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.