By Rick Sohn, PhD

Umqua Coquille LLC

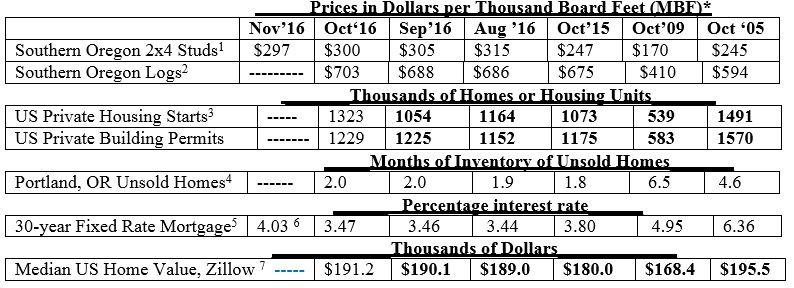

Housing starts achieved a new 9-year high, while interest rates jumped 56 basis points to 4.03%. Logs topped 700 for the first time in 20 months. Recent trends of lumber, logs, home construction, and housing markets, are compared to 2009 and 2005.

* A lumber board foot measures 12 inches by 12 inches by 1 inch. The log board foot is based on an industry standard pattern for sawing straight boards from round, tapered logs. The leftover wood and bark become chips and sawdust, which are used for paper, fiberboard, and fuel to make electric power. In the Pacific Northwest two truckloads of logs make enough wood product to build a new home.

* A lumber board foot measures 12 inches by 12 inches by 1 inch. The log board foot is based on an industry standard pattern for sawing straight boards from round, tapered logs. The leftover wood and bark become chips and sawdust, which are used for paper, fiberboard, and fuel to make electric power. In the Pacific Northwest two truckloads of logs make enough wood product to build a new home.

Interpretation and Looking Ahead.

The biggest news is the 56 basis points, or 0.56 of 1% rise in the mortgage interest rate in the last month – from 3.47 to 4.03 (the latest weekly rate), basically since the election. The rise correlates with an increased stock market, and less interest in bonds.

For comparison, the rise is smaller in total than May 2 to June 27, 2013 (2 months) when the rate jumped from 3.35 to 4.46, or 111 basis points in basically 2 months. Of course, this current adjustment may not be over.

Going way back, to March 7-April 4, 1980, 36 years ago, the mortgage rate jumped from 14.0 to 16.35%, in one month!!! This is a 16.8% rise, whereas the rise this last month, for comparison, is slightly smaller, a 16.1% rise. Next month could break new ground on interest rates, so stay tuned.

Housing starts finally broke out of their doldrums of last month, and set a 9-year high. After the slowdown last month this is a welcome statistic. Building permits are stable, as is unsold inventory of homes. In contrast, home values continue to rise steadily, as reported by Zillow.

Studs are flat to dropping, which was unexpected, after the harsh domestic fall weather. Of course the unregulated export of lumber from Canada, in the absence of an export duty, complicates the issue. There is no resolution in sight.

Logs are above $ 700 for the first time since February 2015. How much higher logs go is hard to say, but movement up in product prices could cause log prices to rise further.

Mike Cloughesy of Oregon Forest Resources Institute recently pointed out that Oregon is the number ONE state in the nation for growing trees and number ONE state for producing solid lumber and plywood products. Likely, it’s also the largest producer of laminated veneer and laminated lumber products as well.

However, Georgia is number one for harvesting trees. How can this be? Oregon is the top producer but not the top harvester? It’s because wood comes into Oregon from surrounding states, Canada, and elsewhere due to restrictions on harvest from Federal and State lands in Oregon. More-so every year, the excess of Oregon tree growth over harvest is catching up with us in the form of overcrowded forests, fires and diseases that kill and harm forest health.

Figures in bold are adjusted monthly. Data used with permission. 1Random Lengths. Recent week Kiln Dried 2×4-8′ PET #2/#2&Btr lumber. 2RISI, Log Lines. Douglas-fir #2 Sawmill Log Average, Southern Oregon region. 3 Annualized monthly. US Dept of Commerce. 4Portland, Oregon Regional Multiple Listing Service, courtesy of Janet Johnston, Prudential Real Estate Professionals, Roseburg, OR. 5Freddie Mac. National monthly average. 6 Federal Reserve Bank of St Louis Economic Research, National Average, most recent week. 7Zillow.com, National Median home value. (http://www.zillow.com/or/). © Copyright Rick Sohn, Umpqua Coquille LLC. Issue #9-11. For more information, questions, or permission to reprint, please e-mail me at [email protected].

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.