By Oregonians for Food and Shelter,

Discussions around a new $2 billion corporate activities tax dominated the Capitol. HB 3427 was introduced as the vehicle for a tax package to generate NEW revenue to fund proposed K-12 education programming. The bill sits in the new Joint Student Success Committee, which was created in 2018 for the purpose setting education funding priorities and finding the tax revenue to fund them.

Currently, the Committee is considering the structure in the -1 amendments, which include:

- If you have over $1 million in taxable Oregon receipts you will be subject to a minimum $250 tax plus .49% on receipts above $1M

- No tax is due if the business receipts are less than $1 million

- Out of state wholesale sales are exempt

- Ability to subtract 25% of either business inputs or labor costs in the calculation of a company’s business receipts

- A slight reduction of personal income tax rates

- A complete summary

The proposal is a modified gross receipts tax that ignores net income and a company’s ability to pay, would pyramid tax liabilities, harm high cost/low margin companies and pass costs down to consumers. Thursday evening, many agricultural groups submitted joint testimony to the committee in opposition to the proposal and lining out industry specific issues with the proposal.

Legislative leadership is attempting to move the bill on an aggressive timeline. Tuesday evening, Legislative Revenue staff reviewed the -1 amendments, and the Committee held its first public hearing Thursday evening. Oregon Farm Bureau has sent out an Action Alert to generate comments to the committee.

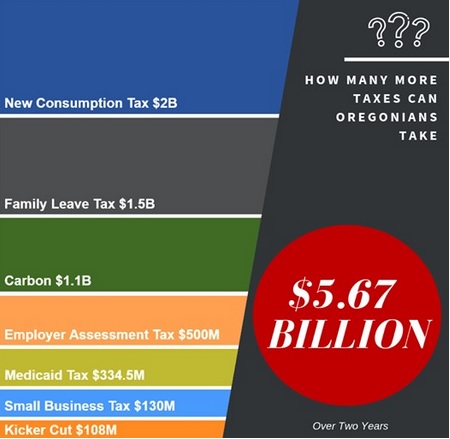

This tax proposal is only one of several business costs being considered this Session with total impact of over $5.6 billion! Oregon Business & Industries has created the following infographic questioning how much Oregonians can bear.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.