By Oregon Small Business Association,

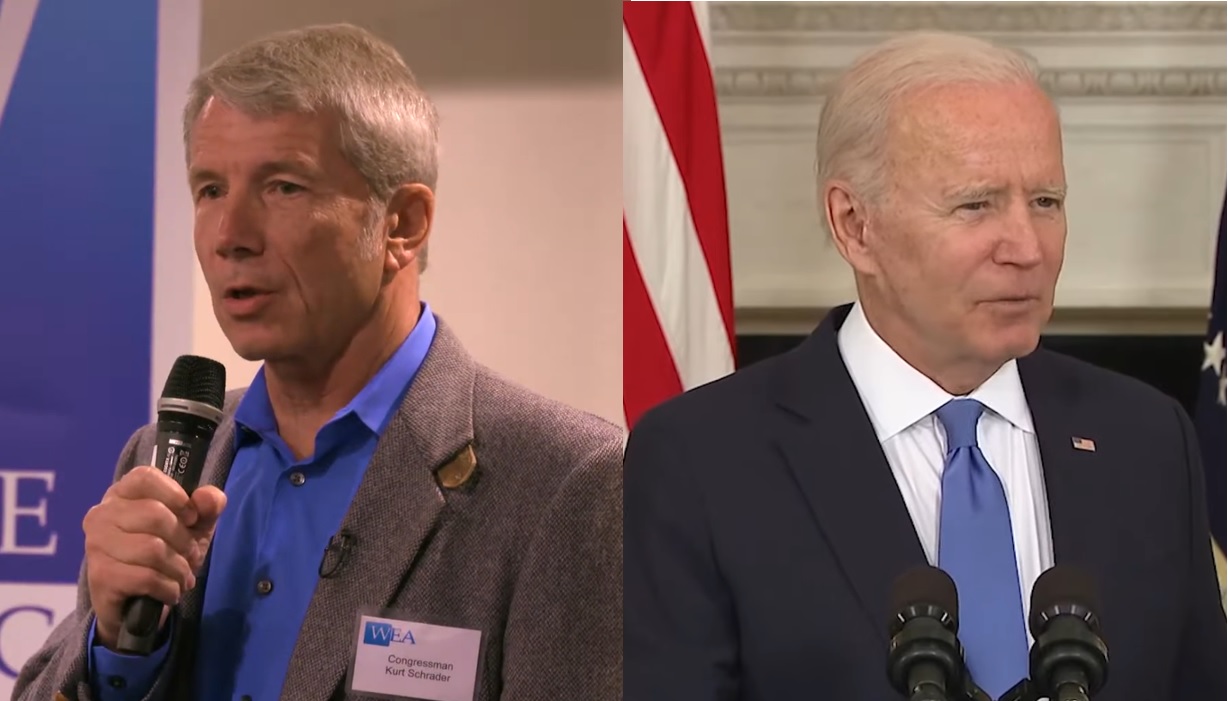

Oregon Congressman Kurt Schrader signed a letter along with thirteen other Democrat Members of Congress. asking President Biden to exempt farmers from his new tax plan which includes the repeal of stepped-up basis.

The letter states,

“…we write to express concern over the impact that certain tax changes enacted to pay for this package could have on our family farms and local economies. The repeal of stepped-up basis for capital gains and immediate taxation could especially hurt family farms, some of which have been in families for generations; therefore, we strongly urge you to provide full exemptions for these family farms and small businesses that are critical to our communities….The requirement to recognize capital gains at death runs the risk of forcing farms and ranches to sell part, or all, of a farm that may have been passed down for several generations in order to pay the tax burden. While the ability to simply sell a small part of an asset may work for those with shares of stocks, it would force farmers to break up land that may have been in their family for decades and seriously impact their ability to remain economically viable. Additionally, eliminating stepped-up basis without an exemption for our farmers presents administrative difficulties. For example, shares of stock or many other assets are relatively simple to value, and taxing other assets when they’re sold gives a clear reference price for valuation, so capital gains taxes have thus far been relatively simple to administer. However, since farms, machinery, and some small businesses may be illiquid or difficult to value, the administrative difficulty is increased.”

The Wall Street Journal commented

“I’m laying down the marker, and I’ve got 13 colleagues who say we agree,” Ms. Axne [Rep. Cindy Axne (D., Iowa),] said. “And many of us come from really difficult seats.” President Biden’s tax plan would raise the top capital-gains tax rate to 43.4% from 23.8%. It would also alter what happens when people die with unrealized gains in stocks, land, businesses or other assets.”

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.